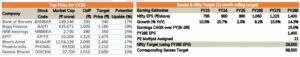

Anand Rathi has conducted a thorough analysis of the best Banking (PSU & Private) and NBFC stocks to buy now. After the analysis, clear cut recommendations have been given of the stocks to buy and the rationale for the same

Anand Rathi has conducted a thorough analysis of the best Banking (PSU & Private) and NBFC stocks to buy now. After the analysis, clear cut recommendations have been given of the stocks to buy and the rationale for the same

Our Stocks Talk Forum already has 800+ investors having stimulating discussions on stocks. Please join us asap

Anand Rathi has pointed out that the drop in lending to the corporate sector (which has halved in FY15 from FY14) because of the capex slowdown has compelled banks tofocus on other lending avenues, primarily on the retail and SME segments. It states that India, given its favourable demographics, has huge potential for retail lending. It thus expects the share of retail loans in lending to climb from 19% in FY14 to 24% over the next four years. It has identified the best stocks in the Bank (private banks and public sector banks) and NBFCs in the housing finance, vehicle finance and retail loans.