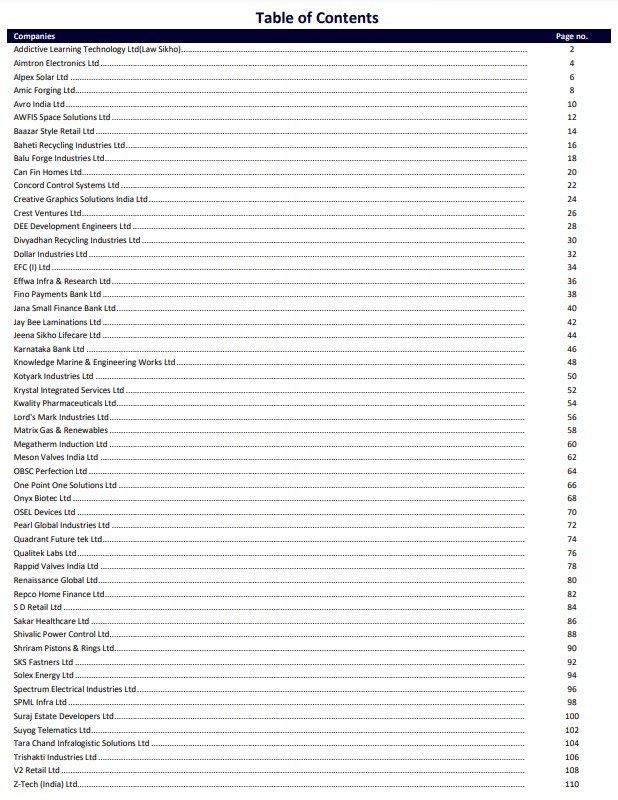

Nuvama has conducted a detailed stock analysis of the most promising emerging stocks like Aimtron Electronics, AWFIS Space Solutions, Balu Forge Industries, Can Fin Homes, Concord Control Systems Ltd, Jana Small Finance Bank Karnataka Bank Ltd, Knowledge Marine & Engineering Works Ltd, Krystal Integrated Services Ltd, Megatherm Induction, Repco Home Finance, Shivalic Power Control, Shriram Pistons & Rings V2 Retail Ltd etc

Nuvama has conducted a detailed stock analysis of the most promising emerging stocks like Aimtron Electronics, AWFIS Space Solutions, Balu Forge Industries, Can Fin Homes, Concord Control Systems Ltd, Jana Small Finance Bank Karnataka Bank Ltd, Knowledge Marine & Engineering Works Ltd, Krystal Integrated Services Ltd, Megatherm Induction, Repco Home Finance, Shivalic Power Control, Shriram Pistons & Rings V2 Retail Ltd etc.