It is well-known that the surging interest rates is causing the plunge in the stock market. The yield on US Treasuries is 5% which makes it attractive for institutional investors seeking a risk-free return on their investment.

LATEST: The 10-year US Treasury yield exceeds 5% for the first time since 2007, signaling more pain for bond investors https://t.co/JNOoDZmnlJ pic.twitter.com/AG4M6tLl57

— Bloomberg Markets (@markets) October 23, 2023

The other consequence of the rising interest rates is that the Bond values plunge.

Bill Ackman had predicted that the interest rates would rise and had shorted 30-year bonds using options, derivatives.

According to the FT, Ackman made a gain of $200M from the short position.

“Billionaire hedge fund manager Bill Ackman made a profit of about $200mn from his high-profile bet against US 30-year Treasury bonds, according to people familiar with the trade,” it was reported.

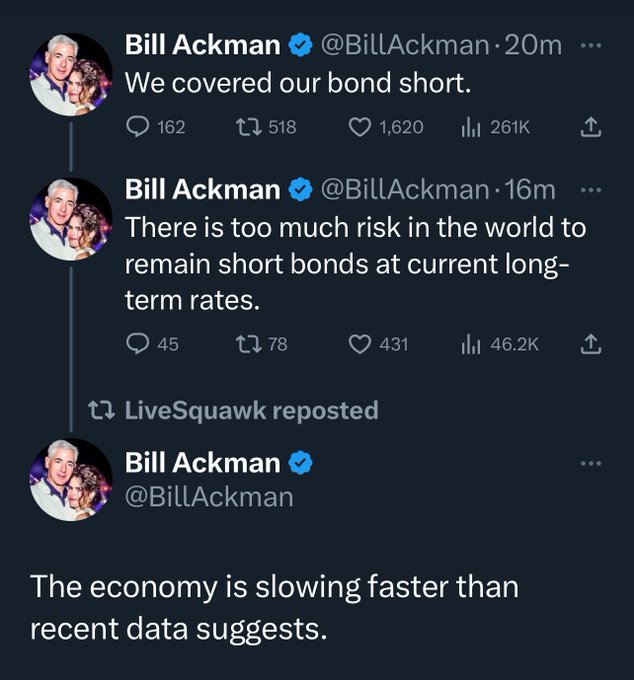

Ackman has come on record to state that he has covered his shorts.

“We covered our bond short. There is too much risk in the world to remain short bonds at current long-term rates,” he said on X, formerly Twitter. “The economy is slowing faster than recent data suggests,” he stated.

We covered our bond short.

— Bill Ackman (@BillAckman) October 23, 2023

It is obvious that if interest rates start to dip, there will be a corresponding demand for stocks because investors looking for a higher yield will buy stocks.

So, this is an appropriate time to take advantage of the rout in the stock market buy high-quality stocks.