Mumbai: Shares of key Indian pharmaceutical Contract Development and Manufacturing Organisation (CDMO) players, including Divi’s Laboratories, Syngene International, Laurus Labs, and Blue Jet Healthcare, witnessed a sharp surge of up to 5% on Friday, October 10, following the US Senate’s approval of the National Defence Authorisation Act (NDAA), which included an amended version of the US Biosecure Act.

The legislation, passed by a significant 77-20 vote, aims to significantly reduce the US’s dependence on foreign labs and suppliers, particularly those from China deemed as “biotechnology companies of concern” (BCC).

Macquarie Bullish on Indian CDMOs

Global brokerage firm Macquarie quickly reacted to the development, reiterating its “Outperform” rating on a clutch of Indian pharma companies: Divi’s Laboratories, Cohance, Syngene, and Blue Jet Healthcare.

According to Macquarie, the NDAA bill embedded an amended version of the US Biosecure Act, which prohibits the use of “biotechnology equipment or services” from any BCC in Federal contracts. The brokerage noted that these prohibitions will take effect 60 days following the revision of the Federal Acquisition Regulation concerning these companies.

The India Advantage

The Biosecure Act is primarily designed to safeguard American biotech and health data from foreign threats, leading US drug makers to actively seek alternative supply chain partners. This geopolitical shift is expected to unlock massive opportunities for Indian CDMOs.

Industry sentiment in India is highly optimistic, with companies believing that the Contract Manufacturing or the CRDMO (Contract Research, Development, and Manufacturing Organisation) sector could triple or quadruple in size in the next four to five years.

Indian CDMO companies are already experiencing an uptick in business, with firms that had previously not considered India now shifting their focus. Executives from top firms confirmed the trend:

- Divi’s Labs: “We are seeing a spike in opportunities coming our way.”

- Laurus Labs: “This is being seen as a good step towards CDMO opportunities for Indian companies.”

- Neuland Labs: “U.S. customers are looking at an alternative to China, so business is coming.”

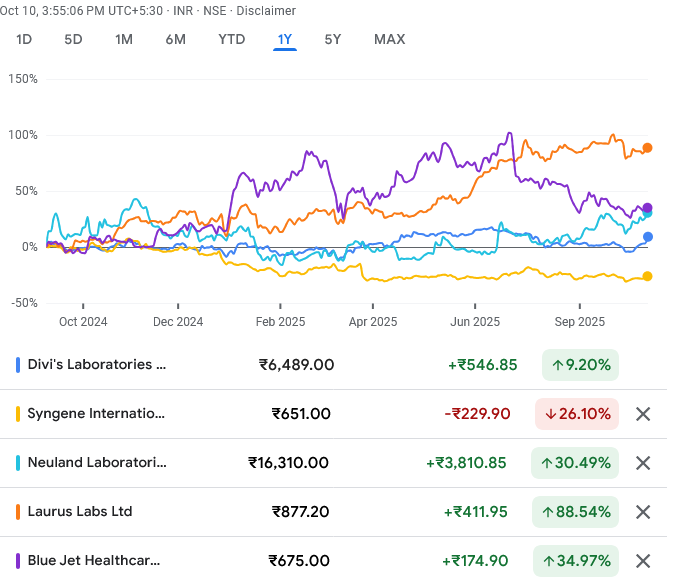

Stock Movement

Investor enthusiasm was reflected in the stock performance of the potential beneficiaries:

- Divi’s Laboratories surged as much as 4.5% to trade at ₹6,411. The stock has posted a robust 6.3% rise over the last one month.

- Blue Jet Healthcare was trading with gains of 4.6% at ₹683.55.

- Laurus Labs climbed 2.6% to trade at ₹887.65.

- Syngene International gained 2.3%, trading at ₹653.25.

Other firms expected to benefit from this shift include Neuland Labs and Piramal Pharma. The legislative move positions India as a crucial and reliable player in securing the global pharmaceutical supply chain, promising accelerated growth for its high-quality, regulatory-compliant Contract Manufacturing sector.