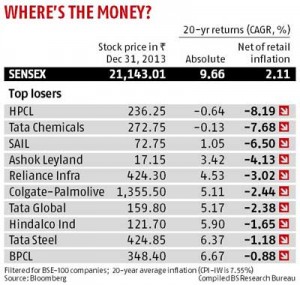

A report by Joydeep Ghosh in the Business Standard makes for shocking reading. It shatters the myth that investing in Blue Chip stocks over a long period of time always guarantee’s success. Instead, the report reveals that the return from such stocks over a period of 20 years is even lower than what you would’ve got from a fixed deposit.

It is astonishing to learn that Blue Chip stocks like Hindalco, Tata Steel, Colgate-Palmolive, Ashok Leyland, Reliance Infrastructure, Tata Chemicals and Tata Global Beverages have offered a return which is less than the average Consumer Price Index (CPI) -based inflation (for industrial workers) of 7.55 per cent. Even Titan Industries, Rakesh Jhunjhunwala’s crown jewel stock, has barely eked out an average return of 11.68 per cent over 20 years.

PSU & OMC stocks were as expected in the dog house. Hindustan Petroleum Corporation, Steel Authority of India Ltd and Bharat Petroleum Corporation Ltd did not given a return which matched the inflation rate.

Nilesh Shah of Axis Capital put the issue in prespective by pointing out that even for blue-chip stocks, investors had to ensure that they were buying at a good price. He also said that if the blue-chip changes its business decision, it’s time to evaluate and exit the stock.

He explained that while Hindalco and Tata Steel were companies with great cash flows, their business models changed when they went for big acquisitions and became debt-laden. Others like Colgate-Palmolive suffered from intense competition from other heavy weights like Proctor & Gamble and HUL.

Gul Tekchandani also made the sensible suggestion that investors had to constantly monitor and check numbers like return on equity and return on capital, based on quarterly or half-yearly numbers. “You just can’t buy a stock and hold it forever. Give it time for three years to perform and then exit. Also, when the economic growth rate comes down from eight per cent to four per cent, some sectors are bound to suffer,” he was reported as saying.

V K Sharma of HDFC Securities cautioned that stocks, especially cyclical ones, need to be sold before they peak. He suggested that the best way for passive investors, without passion or time for research, is that they should invest in index exchange-traded funds (ETFs), as good stocks are held in the index and bad ones get thrown out.

Hi,

The above CAGR return calculation considers dividends and bonus share issued during 20 years period ?

Does the 20 CAGR Return % is the calculation between stock price 20 years back and current price ?

Thanks

Vijay

Good point Vijay,I also doubt the validity of this ‘research’.Titan has certainly grown Huuuugely over the years.So have HUL,Colgate,etc.Maybe the steel stocks haven’t done as well.But its hard to believe that this would’ve been possible given the average 5-6% GDP growth India has managed over the past 20 years…maybe the comparison has been made between the top 20 years back & the bottom of this year.Who knows?

On 1.1.2000, Titan was quoting Rs. 7.75. In the period from 1.1.2000 to 1.1.2014 (14 years), Titan has given an absolute return of 2820% which means a CAGR of 27.2416%.

In the initial years, Titan suffered heavy losses. If you go back 20 years (1.1.1994) and assume that Titan was quoting on 1.1.94 at Rs. 26, then at today’s CMP you would have a CAGR of about 11.42% which is what the original article alludes to.

Unfortunately, Titan’s stock price pre-2000 is not available and so it cannot be verified though it is not unrealistic to imagine that Titan may have lost ground in its initial years.

Titan’s explosive gains came from April 2009 onwards when it went to a vertical climb from about Rs. 40 onwards to the CMP of Rs. 226 give a CAGR of 41.3871.