Nifty Outlook:

The index has been trading in a range post the gap down that was witnessed on 18th Jan. The sell-off was largely led by bearish FII activity in all the segments. As far as FII activity is concerned, FII’s have

gone aggressively short in index futures at 87,351 – highest since 30th November 2023. On 31sh January; 18,276 long contracts were added compared to the addition of 5,671 short contracts in index futures. The long/short ratio has significant come down from 48% to 30%; indicating unwinding of long positions. Additionally, on the index options front, the data has become negative as the FII’s have added significant call shorts at higher levels; which is a bearish indicator. To conclude, the data is still negative from FII’s point of view now. Option data is indicating further weakness can be expected if the support zone of 21,500 is breached on closing basis. Advisable to avoid heavy longs atthisjuncture.

Weekly Expiry Point of View:

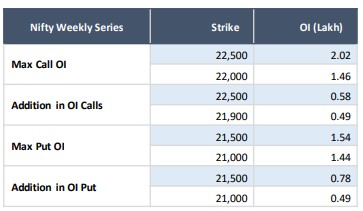

Option chain data for today’s weekly expiry is indicating a trading range of 21,500-22,000 zones. On the call side, 22,000 is the strike with highest OI. Majority of call writing was witnessed at this level;

indicating resistance. On the putside, 21,500 is the strike with highest OI. As per the data, net call-put writing is indicating a bearish stance from the FII’s. They are still holding significant call shorts at higher levels; indicating resistance for the index. Further weakness can be seen if the index breaches the supportzone of 21,500 on closing basis.

Interim Budget Play Strategy:

The sentiment on Nifty is slightly bearish. However; the index is likely to trade in a wide range of 20,950 – 22,400 zone. For aggressive participants, one can play this range by deploying a short straddle which involves selling 1 ATM CE & PE.

Nifty Short Straddle MONTHLY expiry:

SELL 1 LOT PUT NIFTY 29FEB2024 21,700 @ 334 | SELL 1 LOT CALL NIFTY 29FEB2024 21,700 @ 420

Note: Since the budget day is dynamic in nature, we would be deploying the SL depending on the market scenario

Click here to download Budget Day Derivatives Strategy 1st February 2024