Upside drivers include strong multi-year revenue visibility, margin expansion from higher-value products, improving working...

investments

We view the issues highlighted as largely disclosure-related discrepancies and instances of misinterpretation arising...

We estimate FY25-28E revenue/EBITDA/PAT CAGR of 46.4%/48.4%/41.2%, with EBITDA margin expansion of ~60bps

Antolin acquired at an attractive valuation; diversification engine to start firing

JSWINFRA is pursuing an aggressive logistics infrastructure build-out under JSW Ports Logistics, supported by...

KKPC is well placed for healthy long-term growth

Long-term government contracts provide stable revenue and renewal-dependent cash flows, minimizing volatility and deepening...

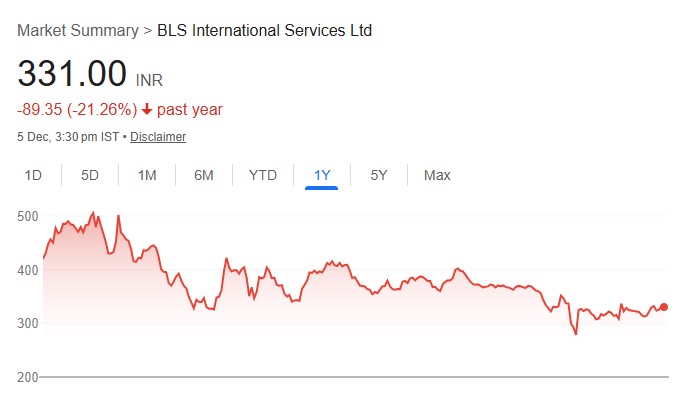

Strong 1500+ points Rally in Nifty 50 since Oct’25: After seeing some pullback in...

The company is working on several new products that are either under development or...

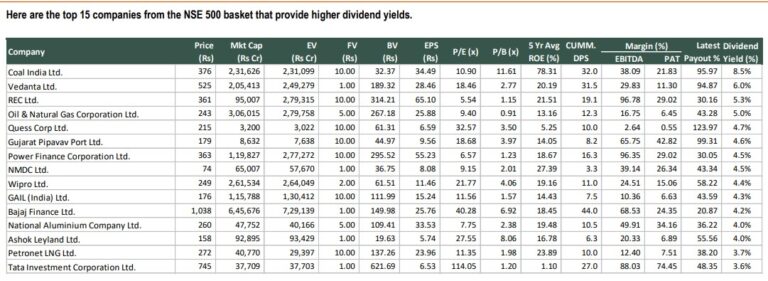

List of top 15 companies from the NSE 500 basket that provide higher dividend yields by IDBI Capital

Here are the top 15 companies from the NSE 500 basket that provide higher...