The rally in Tata Communications comes in the wake of TCS’ announcement of a...

investments

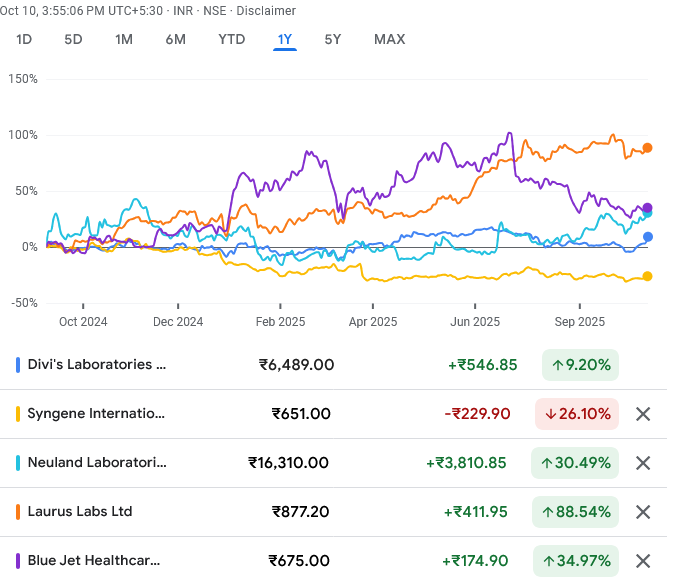

Biosecure Act Passage Triggers Rally in Indian Pharma CDMO Stocks; Macquarie Reiterates ‘Outperform’

CRDMO sector could triple or quadruple in size in the next four to five...

Current order backlog of Rs. 44.1bn provides revenue visibility for the next 18-24 months.

For long-term investors, Shilpa Medicare may be entering a zone worth monitoring closely. For...

SDL is expected to clock INR 100bn+ in sales for FY26 (+70% YoY), supported...

The sentiment among professional traders highlights a growing concern that such hyper-volatility, combined with...

The twin scandals have dealt a severe blow to IndusInd Bank's reputation. The bank's...

Kacholia’s investment reinforces the rising relevance of the recycling industry within India’s manufacturing landscape....

Kedia’s entry into Eimco Elecon has drawn attention to an otherwise overlooked mid-cap industrial...

The leading indices exhibited subdued performance throughout SAMVAT-2081 due to various challenges.