Piramal Pharma Solutions (PPS), the CDMO arm of Piramal Pharma, has announced a multi...

investments

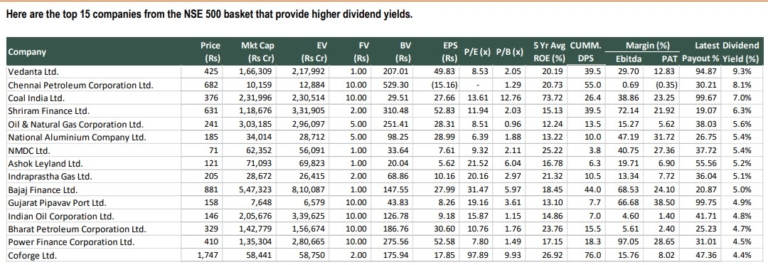

Here are the top 15 companies from the NSE 500 basket that provide higher...

SUEL stands to benefit from regulatory tailwinds mandating local content (ALMM for wind), a...

FY25 was a stellar year for Eureka Forbes (EFL), visible from a) step-up in...

FY25 was the year of transition of the bank under the new management spearheaded...

Adani Ports & SEZ (APSEZ) has transformed from a pure-play port operator into India’s...

We believe Coforge’s strong executable order book and resilient client spending across verticals bode...

As per our DCF analysis (WACC: 10.5%), at CMP, PLNG is pricing in an...

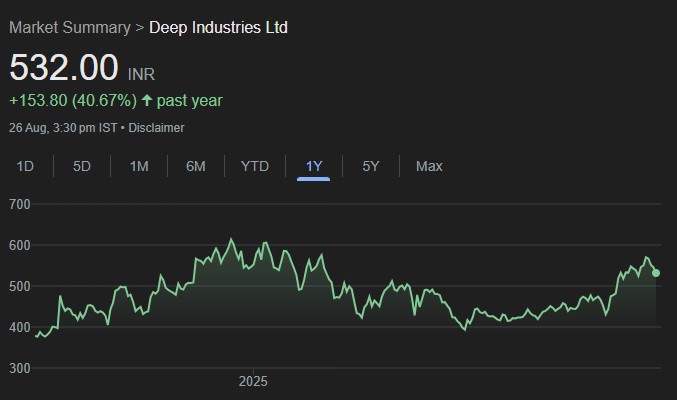

Ahmedabad-based Deep Industries Ltd. (DIL) began in the 1990s as a pioneer in gas...

ITCH has a strong debt-free balance sheet with a net cash position of INR...