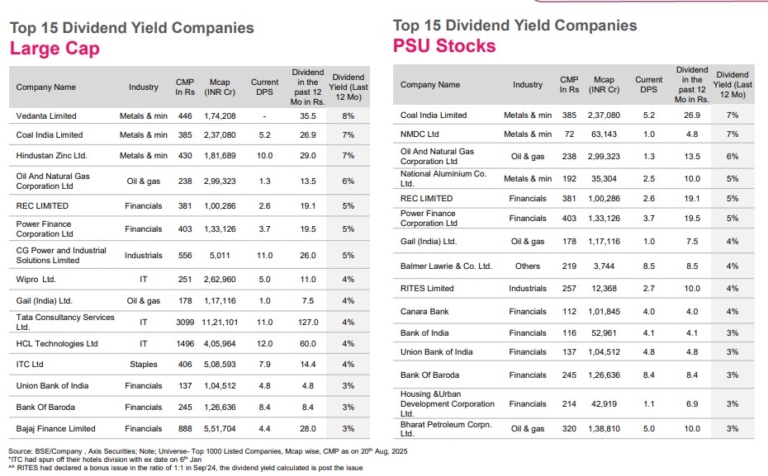

Top 15 Dividend Yield Companies as of 21st August 2025 segregated from the Large-Cap,...

investments

Hi-Tech Pipes has strong growth prospects in the structural steel tubes space given its...

Sunteck Realty (SRIN) is on a project acquisition spree with an aim of doubling...

We recently hosted Piramal Pharma Ltd at the JM Financial Promoter Conference, represented...

ETHOS is expected to continue delivering strong topline growth in the coming years, driven...

Brigade Enterprises Ltd. (BRGD) is one of India’s leading property developers, with over three...

HG Infra is strategically positioned to attain 15.1% revenue CAGR over FY25- 27E, supported...

IGPL is a near net cash company with strong foothold in domestic market focussing...

Campus Activewear delivered a muted Q1FY26 performance, broadly below our expectations. Revenue grew 1.2%...

DIL’s strong brand recall coupled with deeper penetration and consumers shifting towards affordable branded...