The 2 acquired subsidiaries – IAC India and GreenFuel Energy continue to drive growth...

investments

EIL is strategically skewing towards consultancy and cost-plus/OBE turnkey contracts, protecting margins from cost...

We expect Revenue and PAT to grow at 29.8% and 32.8% CAGR over FY25-FY28E.

We anticipate healthy double digit net sales growth and operating margin expansion in near...

DIL’s strong brand recall coupled with deeper penetration and consumers shifting towards affordable branded...

Management indicated that on-ground demand momentum remained healthy in 3QFY26

The company has revised its guidance for revenue growth to be around Rs 3,000...

As of Dec’25, MAN’s aggregate executable order book stands at ~Rs 4,000 cr, providing...

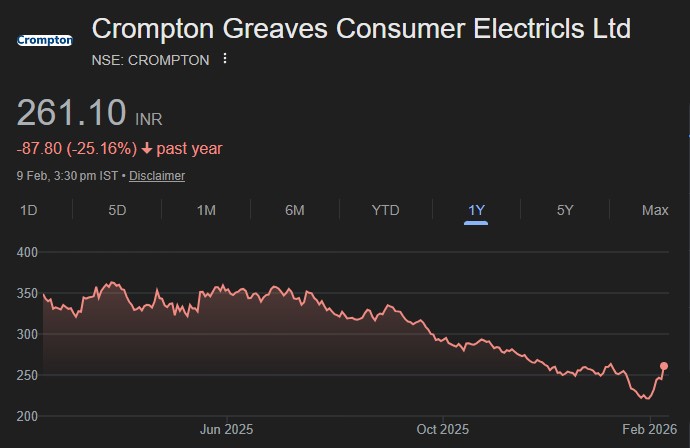

It continues to gain market share across categories, with particularly strong momentum in BLDC...

Jubilant Pharmova (JPL) is an integrated, multi-dimensional pharmaceuticals company with global presence.