Long-term government contracts provide stable revenue and renewal-dependent cash flows, minimizing volatility and deepening...

investments

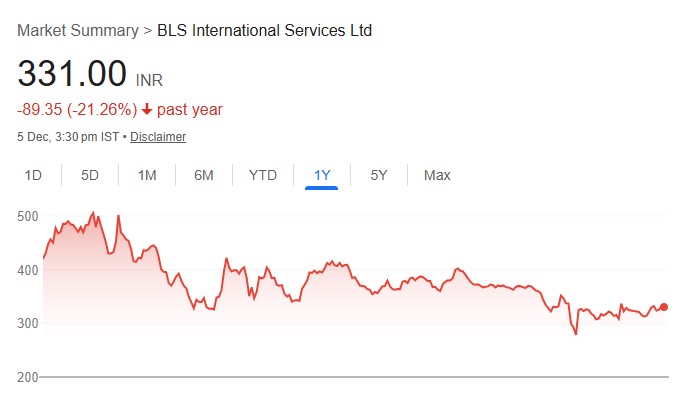

Strong 1500+ points Rally in Nifty 50 since Oct’25: After seeing some pullback in...

The company is working on several new products that are either under development or...

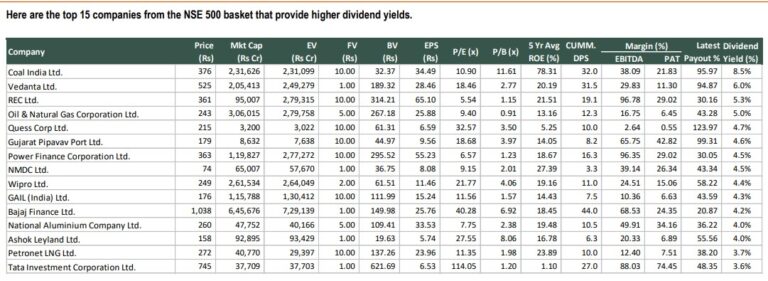

List of top 15 companies from the NSE 500 basket that provide higher dividend yields by IDBI Capital

Here are the top 15 companies from the NSE 500 basket that provide higher...

Material opportunities in ultra-pure water market: semiconductors, green hydrogen, data centers

BIL has significantly outperformed the industry (revenue CAGR of 11.5% over FY16–25, compared to...

Premier has one of the strongest balance sheets and is likely to generate ~INR...

We expect PRIVI to deliver a CAGR of 27%/34%/46% in revenue/EBITDA/adj

Our FY25–27E revenue CAGR estimate of ~17% is conservative against the company’s guidance of...

Healthy B/S with consistent net debt reduction