Cello World Limited (Cello) is a household brand with presence across categories, such as consumer houseware (FY23 contribution: 66%); writing instruments & stationery (16%); and moulded furniture & allied products (18%). The company has over six decades of experience in scaling up new businesses and carving out leaders among them.

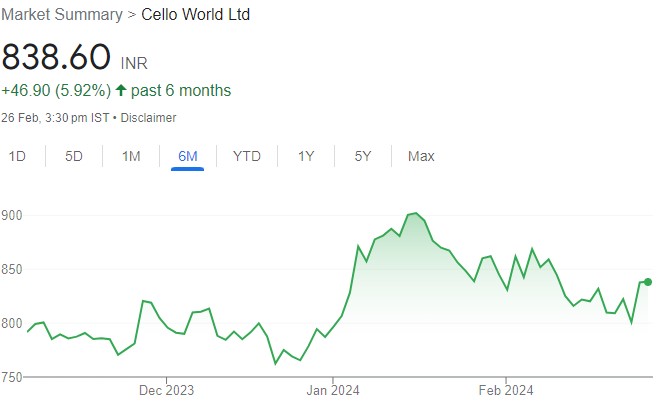

We estimate CELLO to grow faster than the industry. The company is expected to post a robust revenue/EBITDA/Adj. PAT CAGR of 18%/23%/25% over FY23-FY26. This will be driven by the expansion of both SKUs and distribution reach, coupled with strong growth in the glassware segment post commissioning of the new plant in Rajasthan. Cello is currently trading at 35x FY26E P/E with an RoE/RoCE of 32%/39% in FY26E. We initiate coverage on the stock with a BUY rating and a TP of INR1,100 (premised on 45x FY26E P/E).

Click here to download the research report on Cello by Motilal Oswal