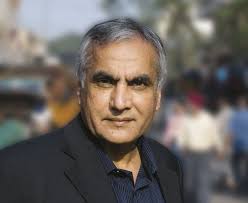

Ajay Relan, founder of CX Advisors, became world-famous (amongst us) because his stock pick, MPS, delivered 3-Bagger returns in a short period of time.

Since then, we have been keeping a red alert for his stock picks.

Now, to our good fortune, Outlook Business has asked Ajay Relan to choose his best stock pick for 2015.

That stock is Career Point, a micro-cap with a market capitalisation of only Rs. 300 crore. The company is engaged in providing tutorial services for various competitive entrance examinations like AIEEE, IIT-JEE, AIPMT and PDT. The company provides these services through company operated training centres, franchisee centres and distance learning programmes. The company has also forayed into K-12 schools and higher education.

(Ajay Relan delivers an impressive talk on entrepreneurship in which he refers to Ashish Dhawan of ChrysCapital as an example of how someone with “zero investing experience” ran a successful private equity firm)

Ajay Relan points out that Career Point is a “fallen angel”. In 2011, the company was flying high with peak enrollments of 32,000 students and a very impressive margin of 38%. Its stock price was at Rs. 700 plus. However, a change in the government policy for admissions meant that Career Points’ business model went bust. Also, the company invested heavily in fixed assets for building schools and colleges which crippled the cash flows. The stock price plunged to a low of Rs. 60 by August 2013.

Ajay Relan explains that the stock is a great buy now for the following reasons:

(i) The business model which was broken as a consequence of the Government action is on the mend. The enrolments are increasing. In the worst-case scenario, it would take another two years for the company to return to its previous peak;

(ii) The formal assets have also started contributing to the bottom line;

(iii) The formal education assets have been divested to a sister concern by funding it with an interest-bearing loan of Rs. 150 crore. If the loan is repaid on schedule and the unused assets are sold for Rs. 50 crore, the company will have Rs. 200 crore in cash versus the market capitalisation of Rs. 220 crore (present Rs. 300 crore). This means that the cash generating asset-light business with the brand name will be virtually free;

(iv) The stock is cheap and is trading at a 40% discount to its tangible net worth;

(v) Career Point is expected to achieve a net profit of Rs. 30 crore by FY17. Applying reasonable earnings multiple of between 20-25x, the business value will be about Rs. 600-700 crore. With the cash in books (expected, if the loan is repaid), the market capitalisation should be Rs. 800-950 crore. Given the current valuation of Rs. 220 crore (now Rs. 300 crore), there is a 4x/ 5x gain to be made.

Ajay Relan expresses the caution that while Career Point’s business model is attractive, the single-most significant threat comes from a change in government policies with respect to admissions in premier colleges.

Incidentally, Career Point was recommended by Sandip Sabharwal also a few days ago. He pointed out that Career Point went into problems because of the change in format of the examinations three years back and that it is now on a comeback trial. He emphasized that the management is pretty focused and clean and that the company is a turnaround one.

Dear Sir,

You are doing an yeoman service by aggregating recos from various places and presenting them all in one place. There is no way a person can manage to read ALL of these from all these various places, **regularly**.

Please keep up the good work!

Thanks & Regards,

-feltra