Dipan Mehta, in his article in the ET, has confidently asserted that 2014 is the super year for mid and small cap stocks.

Dipan Mehta, in his article in the ET, has confidently asserted that 2014 is the super year for mid and small cap stocks.

However, because mid and small cap stocks have high risk, investors should only buy stocks that meet the checklist.

Apart from the subjective and general parameters such as management quality, industry prospects, past track record, competitive position etc, Dipan Mehta has prepared a more quantitative and objective checklist which is as follows:

1. Corporate governance is of utmost important. So, check that the number of Independent Directors are more than 4 and that they are individuals of repute and standing. Also check that the auditors are a well known and reputed audit firm;

2. High debt has destroyed many businesses. So, check that the Debt-Equity ratio is less than 0.5 and that the promoters have not pledged their shareholding in the company;

3. Check that the company is not guilty of frequent equity dilution. If the EPS keeps getting diluted, even higher profits will not mean higher share prices;

4. Check that the Return on Net Worth exceeds 18 % over a 5 year average. Also, check that the top-line growth over a 5 year period is in excess of 15 %. This will ensure that the company is not stagnating;

5. Check that the company is not in favour of large overseas acquisitions like the Apollo Tyres – Cooper deal fiasco. These over-ambitious deals wreck the shareholders’ wealth;

6. Check the listing record of over 3 years. If the Company has been in skirmishes with SEBI or the Exchanges over violations, avoid it like the plague;

7. Check whether the company needs approval from the Government/government agencies for sourcing raw material, generating revenues, pricing of inputs and finished products etc. If so, avoid the stock;

8. Obviously avoid PSU stocks because they are totally dependent on the Government policies (which are never in favour of the company making all the profits). Dipan cites the example of the BSE PSU Index to point out that in nine long years, the PSU stocks has given a return of only 2.03 times whereas the Sensex is up 4.45 times during the same period.

Dipan Mehta points out that investors must select stocks that have an asset light business model and high return ratios. Since these companies do not require much capital, there is little need to dilute equity. This leads to scarcity value and the resultant appreciation is stock price, he says.

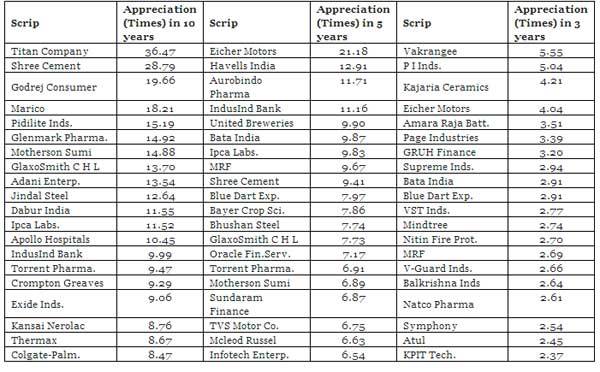

Dipan Mehta’s list of the top 20 best performing mid cap stocks:

very good