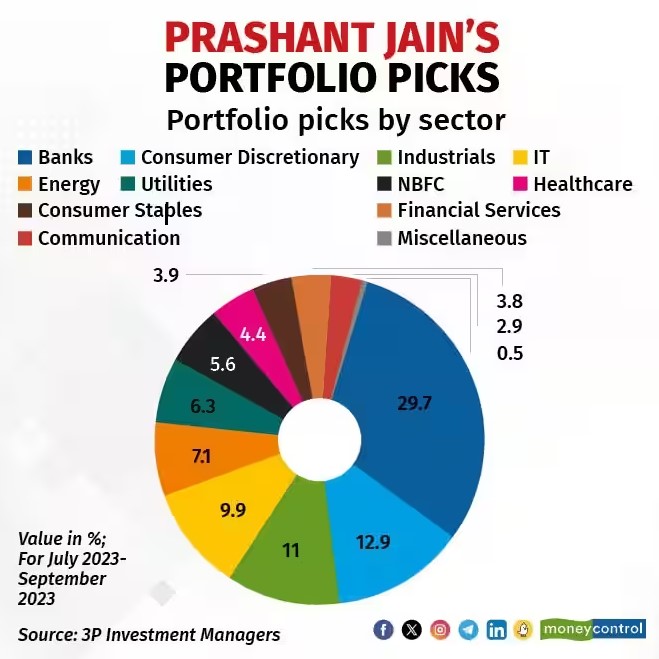

SHAILAJA MOHAPATRA of Moneycontrol has revealed important information relating to the portfolio investments of Prashant Jain’s 3P India Equity Fund based on the Fund’s July to September factsheet.

The AUM of the fund is about Rs 5,800 crore and it is highly diversified with as many as 37 stocks in it.

Highest conviction in Bank and Financial stocks

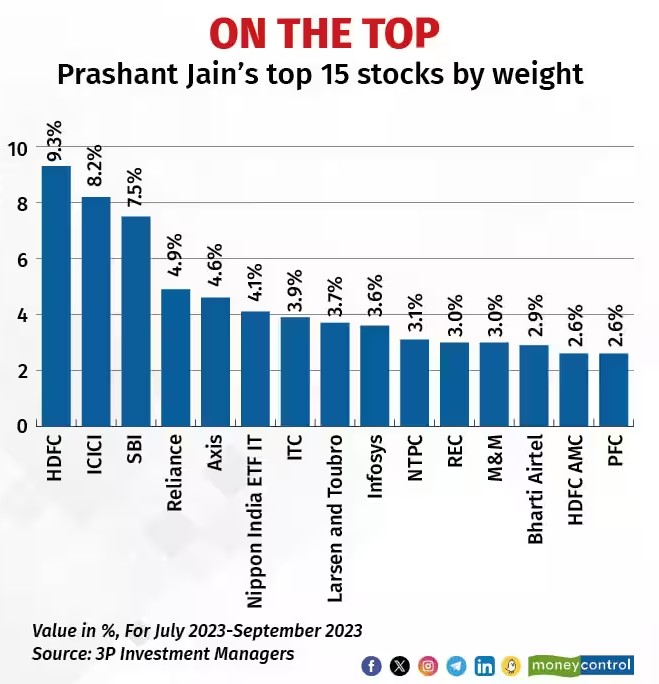

Prashant Jain is understandably bullish about Banking and financial stocks. The Fund has allocated 9.3% of its funds to HDFC Bank. Jain expects the bank to continue gaining market share though at a somewhat slower pace due to increased competition, but he believes valuations remain reasonable.

Regarding the management changes and the recent merger of HDFC and HDFC Bank, Jain said, “Management change is inevitable in all companies, and mergers can have a significant impact on near-term results. However, it is well understood by the markets now, and there are several long-term positives in that merger,” moneycontrol reported.

The portfolio also has 8.2 percent weight in ICICI Bank and 7.5 percent in State Bank of India. It also holds 2.6% in HDFC AMC because the low penetration of financial products, good growth prospects and reasonable valuations makes the stock a good buy. The fund also has an exposure to SBI Life, with 1.3 percent weightage.

(Image source: Moneycontrol.com)

Energy stocks offer good growth and dividend yield

Navratna blue-chips like NTPC, REC and Coal India have to be in every sensible portfolio because they offer excellent investment opportunity of growth and dividend yield. Jain is of the view that the Energy and utilities sectors will see steady growth and attractive valuations and he has invested 13.4 percent of the Fund’s AUM into these stocks.

Industrial stocks are fail-safe

It is obvious that for an emerging economy like India, industrial and consumer discretionary stocks cannot fail. Jain confirmed this thesis by telling moneycontrol “The medium to long-term growth outlook of the Indian economy is extremely strong. Everyone is very positive on the India story,” He also explained that as the per capita income will rise above $2,000, the consumer discretionary sector will sparkle. The industrial sector will also thrive due to the supportive government policies.

Jain has sensibly trusted the large-cap blue chips stocks like Reliance, Mahindra & Mahindra, Maruti Suzuki and Larsen & Toubro to deliver the goodies.

He has also put money into new age companies like Zomato which are very popular amongst youngsters.

(Image source: Moneycontrol.com)

Pharma stocks are ripe for picking

Pharma stocks are presently in the doldrums and not in favour amongst the masses. However, Prashant Jain, renowned for his contrarian instincts, is very bullish about the sector. “These are good businesses and 10-year underperformance relative to Nifty makes it a ripe time for stock picking,” Jain advised. He has picked stakes in fail-safe blue-chips like Cipla, Sun Pharma, IPCA Laboratories and Aurobindo Pharma.

Miscellaneous stocks which can become blockbusters

Prashant Jain is not afraid of experimenting and putting small amounts of money in little-known and experimental stocks. If even only a handful of these stocks being blockbuster winners, the bet is worth it.

With that objective, he has invested relatively small amounts to newcomers like Landmark Cars, Wonderla Holidays, Senco Gold, Anup Engineering, RR Kable, Dynamatic Technologies, Centum Electronics, Technoplast and Vardhaman Textiles.

Latest Portfolio of Prashant Jain’s 3P India Equity Fund

| Sr. No | Stock | % of AUM | Nos of shares | Value (Rs Cr) |

| Banks/ Financials | ||||

| 1 | HDFC Bank | 9.3 | ||

| 2 | ICICI Bank | 8.2 | ||

| 3 | State Bank of India | 7.5 | ||

| 4 | Axis Bank | 4.6 | ||

| 5 | HDFC AMC | 2.6 | ||

| 6 | SBI Life | 1.3 | ||

| InfoTech | ||||

| 7 | Nippon India ETF IT | 4.1 | ||

| 8 | Infosys | 3.6 | ||

| FMCG | ||||

| 9 | ITC | 3.9 | ||

| Energy and utilities | ||||

| 10 | NTPC | 3.1 | ||

| 11 | REC | 3 | ||

| 12 | PFC | 2.6 | ||

| 13 | Coal India | 0.5 | ||

| Telecom | ||||

| 14 | Bharti Airtel | 2.9 | ||

| Consumer discretionary and industrials/capex | ||||

| 15 | Reliance | 4.9 | ||

| 16 | Mahindra & Mahindra | 3 | ||

| 17 | Maruti Suzuki | 2 | ||

| 18 | Zomato | 2 | ||

| 19 | Indigo | 1.8 | ||

| 20 | Larsen & Toubro | 3.7 | ||

| 21 | 3M India | 1.5 | ||

| 22 | Kalpataru Projects | 1.1 | ||

| Pharma | ||||

| 23 | Cipla | |||

| 24 | Sun Pharma | |||

| 25 | IPCA Laboratories | |||

| 26 | Aurobindo Pharma | |||

| Miscellaneous | ||||

| 27 | Landmark Cars | 477000 | 38.7 | |

| 28 | Wonderla Holidays | |||

| 29 | Senco Gold | 960,000 | 69.8 | |

| 30 | Anup Engineering | |||

| 31 | RR Kable | |||

| 32 | Dynamatic Technologies | |||

| 33 | Centum Electronics | 278,700 | 38.3 | |

| 34 | Time Technoplast | 0.4 | ||

| 35 | Vardhaman Textiles | 0.1 | ||

| 36 | J Kumar Infra | 1,077,094 | 53.3 | |

| 37 | Ashoka Buildcon | 32,10,000 | 44.1 |