Vaibhav Global qualifies for a forensic case study analysis at the hands of Prof. Sanjay Bakshi and other experts. It has the unique distinction of going from riches to rags and to riches again. Where it stands now is not clear. In the meanwhile, its shareholders have gone from ecstasy to despair and to ecstasy again.

Vaibhav Global had a torrid time during FY07 to FY10. It incurred heavy losses owing to the heavy investments that it made for acquisitions and launch of TV Channels. The stock price plunged from a high of Rs. 230 to a low of Rs. 11. The situation got so bad that the mighty Warburg Pincus was forced to sell its entire investment of Rs. 245 crore at Rs. 11 crore, suffering a loss of 92%.

However, Nalanda Capital, one of the early investors kept its faith in the stock.

Vaibhav Global came back into the investors’ radar in 2013 when Nirmal Bang and Hem Securities put a buy on it. The logic was that the remedial steps taken by Vaibhav of changing its business model to a full year discount retailing of artificial jewelry through 24×7 TV Channels is a unique, profitable and highly scalable business model. At that time, the stock was at Rs. 133. Within a short time, the stock surged and gave huge multi-bagger returns.

Axis Capital issued a recommendation in August 2014 advising a buy with a target price of Rs. 1140. Axis explains that Vaibhav Global’s potential lies in “simple business economics” that volume ramp up and operating leverage will lead to a spurt in profitability. It estimates that Vaibhav will post 20%/ 30% revenue/ PAT CAGR with sustainable RoE of 30%.

However, after that, something mysterious happened in November 2014 and the stock price slumped. From a high of Rs. 845 on 30.10.2014, it plunged to a low of Rs. 479 on 20.11.2014.

What caused the plunge of nearly 43% in a period of about a month is still a great mystery.

None of the big-ticket shareholders appear to have sold the stock. Maybe the Q3FY15 results may throw some light.

In his write up titled “62 Bagger And Counting: An E-commerce Business That Actually Makes MONEY But Almost Didn’t”, Prof. Sanjay Bakshi looks at Vaibhav Global with a “psychology lens” and portrays an emotional side of how Sunil Agrawal, the promoter of Vaibhav Global, displayed gritty determination and snatched victory from the jaws of defeat by changing the business model.

What is important for us is the “finance lens” through which Prof Bakashi X-Rays Vaibhav Global and explains how the Company now has a virtually “impenetrable moat” due to its “low cost advantage formula”. He states that “VGL’s moat comes from its low cost advantage which is very hard to replicate”.

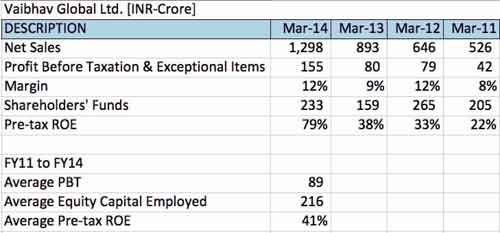

Prof. Bakshi also emphasizes that the huge cost of Rs. 609 crore that Vaibhav Global incurred from FY 11 to FY 14 (and which almost led to its ruin) in setting up TV Channels has now become an “entry barrier” and a source of “operating leverage”.

After more detailed analysis, Prof. Bakshi concludes that Vaibhav Global is a “highly profitable, cash generating, extremely well financed, and dominant business in its space”.

Towards the end, Prof. Bakshi discloses that he has invested in Vaibhav Global “after spending a lot of time thinking about the business, and the man who is running it”. He adds that “After considering various factors, I figured that based on what Sunil has been able to accomplish so far, VGL’s tomorrow will be alright”.

Arjun,

I think Prof Bakshi is seriously out of touch with the markets, TV is dead now and it is the Web and Smartphone that are what is the need of the hour.

2,642.44 Crores valuation for a jewelry selling company by TV like Vaibhav is really a joke and Prof suggesting us to buy is an add on; something is not right!

My2Cents

Bhs

Hi BHS,

When people like Sanjay gives a lecture just read, if you do t understand read again, still if you dont understand. Forget the idea of investing since you are not convinced. BUT keep a close watch of the stock after few months you will start getting convinced when the price start to skyrocket. A recent eg. being Thomas cook, everyone said travel agency is a dead business, people only woke up when there was lot of hype and movement in price considering the future of the businees and its vertical integration, but by that time the train has left.

Regards

Joy

Hi Joy,

Thanks for raising the topic.

A stock price movement should not determine one’s caliber, even some of my investments turned 10-Bagger, it does not mean am great. It is pure luck sometimes.

Prices going up multiple times after the recommendation is out irrespective of the business is pure speculation, and I don’t want to get soaked into it.

What determines a good stock is the business model that the company possess, in this case the business model is not good and is not scalable for sure.

As a Prof, I do respect him but sometimes it just need common sense to get bottom of the story.

My2Cents

Bhs

>>A recent eg. being Thomas cook, everyone said travel agency is a dead business.

FYI.

I like Thomas cook and bought them long ago and still buying on every correction, it is a very good business to be in especially with ever increasing global population and luxury travel!

Regards

bhs

Hi,

Agree with you on Thomas cook, even i bought it pretty early and still buying in every correction. Feels Quess IPO will be a fantastic trigger. Also it seems Sterling deal has started to show in profits. Iam really positive on this stock.

the train has left but for whom…why would anybody buy thomas cook which trades at 140 multiples…whats the logic…why has the price risen…less than two years ago HUL the most well known stock was trading at 450..company came with open offer at 600…now the stock is at 900..its a completely risk free stock…but retail investors never look at these stocks because lack of hype…they never look at the results….sadly these people collide with the brokers / management to create hype around a company to raise its price…then they sell the stocks to retail investors at elevated prices …then the prices crash..results disappoint….the investors get frustrated and sell the stock at lower prices…then again the hype is created and some explanation is cooked up as given for Vaibhav Global..again investors are trapped…its a vicious cycle

Some how, my stomach is saying Vibhav and Poddar Developers are not the right choices this time around, unlike Relaxo and Thomas Cook, I feel they are not in the kind of business that can generate fortunes

In such market, anybody can pump and dump stocks. Don’t trust even highly respected investors blindly.

Just think why proff chose to give eye catchy headline – “62 bagger” ?? He would have given meaningful tagline which highlight his business potential and not attract mass by just past performance.

This is indeed start of bull phase where 99% are swimming naked.