Healthy performance, well poised for profitable growth

About stock: Coal India Ltd (CIL), is the largest coal producer domestically as well as globally. It is a ‘Maharatna’ PSU, operating under aegis of Ministry of Coal.

• Operation spanning 84 mining areas across eight states, currently owing 313 mines including 131 underground, 168 opencast and 14 mixed mines. Q1FY25 Result: Coal India reports steady performance in Q1FY25. Total operating income for the quarter came in at ₹36,465 crore (up 1% YoY) with coal sales volume of 199 million tonne (up 6% YoY). Reported EBITDA stood at ₹14,339 crore with EBITDA margins at 39.3% (up ~160 bps YoY). EBITDA/tonne for Q1FY25 stood at ₹722/tonne vs. ₹726/tonne in Q1FY24. PAT stood at ₹10,959 crore (up 4% YoY).

Investment Rationale:

• Coal remains the cornerstone of India’s energy requirement: Coal remains a primary energy source for India, supplying ~55% of country’s energy and ~70% of electricity needs. Despite an increased focus on renewable/non-fossil fuel-based energy, the demand for coal based thermal capacity is expected to rise to meet domestic energy needs. Consequently, coal demand is projected to reach ~1.3 to 1.5 billion tonnes by 2030 positioning Coal India as a key beneficiary since it produces ~78% of the country’s coal production and fulfils ~40% of energy requirement. Moreover, India imported ~200 million tonne of non-coking coal as of FY24, presenting an immediate opportunity for CIL as a medium-term trigger.

• Large Capex in place to meet its ambitious volume growth: To support the government’s goal of 24×7 power supply, CIL aims to produce 1000 MT of coal by FY26E. We project coal production to grow at 11% CAGR from FY23-26E to 950 MT by FY26E. Key enablers includes: (i) advancement of 119 coal projects with a capacity of 896 million tonnes at a capex outlay of ~₹1.3 lakh crore (ii) better evacuation infrastructure in terms of First Mile Connectivity projects (iii) reviving ~24 discontinued mines of which 11 mines were awarded to bidders on revenue sharing model with reserves at ~267 MT (iv) Engaging with 15 MDOs for targeted capacity of ~170 MTPA

• Diversifying its product portfolio beyond traditional coal mining: CIL is strategically enhancing its portfolio into newer domains such as (i) Coal Gasification project with JV agreements with BHEL and GAIL (ii) Investments in Thermal Power generation with projects like Mahanadi Basin Power Ltd among others (iii) Exploring opportunities for acquiring & mining critical mineral assets in domestic and international geographies.

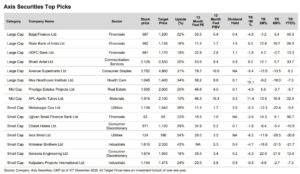

Rating and Target Price

• We maintain a positive view on Coal India amidst healthy volume growth on the anvil, its diversification efforts in new sunrise spaces, healthy net cash positive b/s and robust dividend yield (~5%). We assign BUY rating to Coal India with target price of ₹650 i.e. 5.5x EV/EBITDA on FY26E.