Strong Quarter, Balanced Growth & Compelling Valuations; Reiterate BUY!

Est. Vs. Actual for Q2FY26: NII – BEAT; PPOP – BEAT; PAT – BEAT

Changes in Estimates post Q2FY26

FY26E/FY27E/FY28E (in %): NII: +2.7/-0.1/-0.9; PPOP: +4.4/+1.1/+1.0; PAT: +12.4/+1.1/-0.3

Recommendation Rationale

• NIMs Well-managed; Improvement Visible Hereon: In Q2FY26, DCB reported a surprise 3 bps improvement in NIMs, driven by a sharp 16/17 bps QoQ improvement in CoD/CoF. The management has indicated that NIMs have bottomed out and will continue to improve hereon, barring any further rate cuts. NIM expansion should be led by (a) a focus on the higher-yielding LAP segment versus mortgages, and (b) continued downward repricing of term deposits. Some portion of DCB’s loan book transitions from fixed rate to floating rate, which could impact yields; however, the bank does not foresee any pressure on incremental yields. Moreover, the bank has proactively reduced the proportion of borrowings, and incremental borrowings are being availed at more competitive rates. We expect DCB’s margins to improve over the next few quarters, with CoF/CoD improvement outpacing yield compression. We expect NIMs to settle at 3.3–3.4%, marginally lower than historical levels.

• Asset Quality Improving, Credit Costs Under Control: In Q2, the pace of slippages slowed down sequentially, with the slippage ratio at 3.1% vs. 4.5% QoQ. The management indicated that the pace of slippages in the unsecured LAP/SME and MFI segments has been on a declining trend and expects this trend to continue. DCB aspires to bring down the slippage ratio (ex-gold) to below 2% versus 2.5% currently. While this will not materially impact credit costs, it will enable DCB to reduce opex through lower collection efforts. While the bank has not quantified the impact of the ECL circular, directionally, it does not expect any material impact on credit costs. The management has reiterated its confidence in containing credit costs at sub-45 bps for FY26, and our estimates are in line with the management’s guidance.

• Growth Buoyancy to Continue: The bank has been clocking healthy credit and deposit growth over the past few quarters, largely led by co-lending, while the core mortgage/SME book growth has taken a breather. Hereon, DCB will look to cap the co-lending portfolio at a 15% portfolio mix (versus ~16% currently). The slowdown in the mortgage segment can be attributed to its strategic shift towards sourcing LAP incrementally (the mix in incremental sourcing now stands at 65% versus 50% earlier). It has also moved up the ladder in terms of average ticket size (ATS), without compromising on yields. Furthermore, the bank has tightened sourcing through DSAs and their payouts, and will focus on improving volumes through direct sourcing. DCB aspires to improve customer wallet share by offering multiple products and serving as a one-stop shop for its customers. The bank has also forayed into the Rs 3–10 Cr SME business segment and will look to ramp up the portfolio in a calibrated manner. It aims to double this portfolio over the next 3–3.5 years. We pencil in credit growth of ~20% CAGR over FY26–28E.

Sector Outlook: Positive

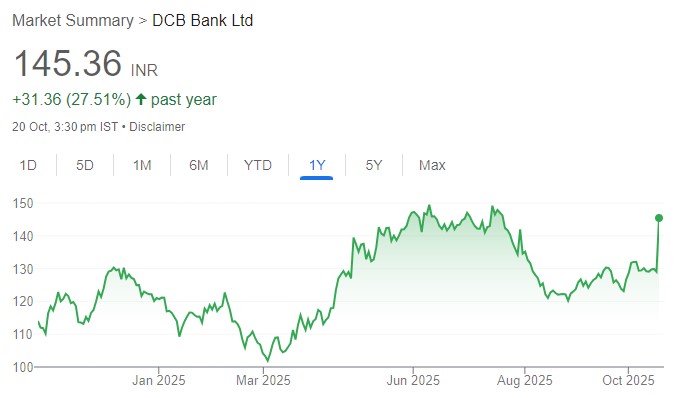

Company Outlook: DCB remains well-positioned to deliver its aspirational RoA of 1% by FY27, supported by (1) Improving NIMs; (2) A strengthening fee income profile; (3) Gradual moderation in the opex ratio driven by improved efficiency and productivity; (4) Range-bound credit costs. We expect its RoA/RoE to improve to 1%/14–16% over FY27–28E, compared with 0.9%/12.5% in FY26. At current valuations, we believe the risk-reward remains favourable. Sustained strong performance across key operating metrics should drive a re-rating in the stock.

Current Valuation: 0.8x FY27E ABV; Earlier Valuation: 0.8x FY27E ABV Current TP: Rs 170/share; Earlier TP: Rs 165/share

Recommendation: We maintain our BUY recommendation on reasonable valuations.