CXO 1X1: Praveen Kutty, MD&CEO

We met Mr Praveen Kutty, MD&CEO of DCB Bank (DCB). Highlights: 1) Management is re-orienting DCB towards being customer-centric, as opposed to being product-centric earlier. Over the medium term, management believes this should ideally enable higher customer engagement, enrich depth of relationship, improve cross-selling, lower cost of acquisition and scale benefits and in whole, position the bank better vs. competition. 2) Co-lending share has grown swiftly to ~13% of overall loans; growth here is now likely to be similar to overall loans. Co-lending is slightly NIM dilutive, but has significantly higher RoE. 3) Given the lead-lag on interest rate, NIM may experience pressure, but DCB expects fee/treasury gains and contained opex to cushion the impact. 4) While a large part of the rise in gross slippages (vs. pre-Covid-19) is related to gold loans (minimal impact on credit costs), the bank aims to further tighten its underwriting. Maintain BUY.

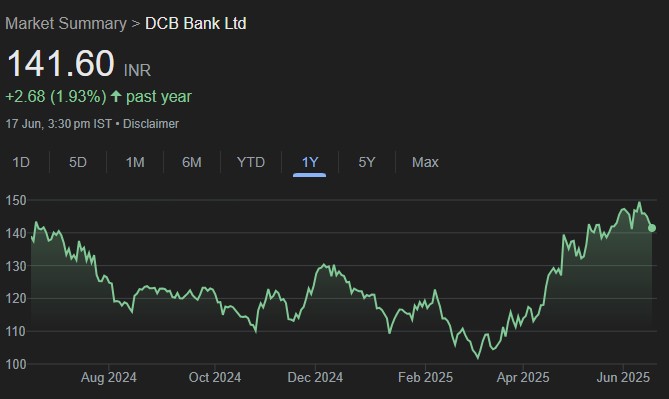

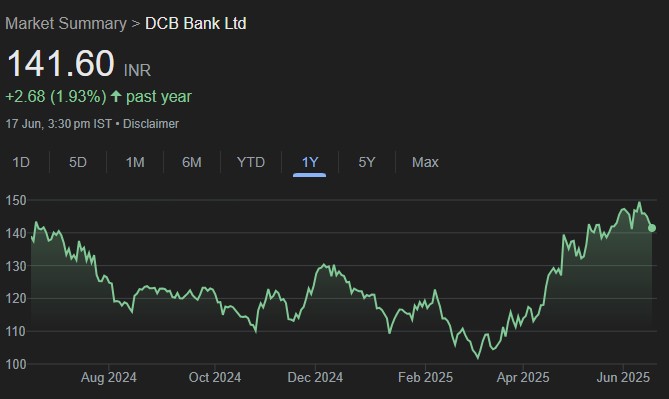

In this report, we also examine the reasons for the significant de-rating of DCB post Covid-19. It is perhaps the only banking stock (without material MFI exposure) where current valuations are similar or lower than pandemic levels. We highlight that DCB has seen a significant rise in gross slippages, though net slippages or credit costs levels have seen little or no differences. The loan growth, even excluding co-lending, has consistently been strong and one of the highest across peers. The heavy-lifting phase on investment in branch/headcount too seems over; RoA improvement could come through once the NIM cycle reverses in FY27. On balance, we maintain BUY with an unchanged TP of INR 175, valuing the stock at ~0.8x FY27E ABV. Key risks: Slower-than-expected operating efficiencies; and higher-than-expected NIM pressure.

Sharp de-rating post-Covid-19; perhaps the only banking stock trading at Covid-19 valuations

DCB’s stock has seen a sharp de-rating post pandemic. For the around five-year period, pre-Covid-19 (2015–20), the stock averaged ~2x multiple on a 1-year forward basis. Excluding the three months of peak crisis, it averaged just 0.8x forward book in the last ~5 years. This is a banking stock (barring banks with MFI exposure) that is still trading at multiples similar to the pandemic.

Surge in gross slippages post pandemic; net NPA higher….

Gross slippages were consistently low at <2% in the pre-Covid-19 phase. DCB saw a surge in slippages to ~6%/5% levels during the Covid-19 phase in FY22/23. Post pandemic, slippages trended lower but for FY25 are still elevated at ~3%.