Offshore Potential with Onshore Expertise: A One-Stop Support Partner for O&G Operations –

Initiate with BUY

➢ Ahmedabad-based Deep Industries Ltd. (DIL) began in the 1990s as a pioneer in gas compression services on a charter hire basis and has since expanded its offerings across the oil and gas sector. With over 30 years of experience, the company specializes in a wide range of support services, including natural gas compression, dehydration, processing, drilling and workover rigs, and integrated project management. DIL covers over 70% of post-exploration services in the oil and gas value chain, positioning itself as a One-Stop Solution provider for field operations. The company offers equipment, services, and skilled manpower on a rental basis, serving upstream & midstream segment.

➢ Deep Industries is well-positioned for growth, driven by a strong revenue outlook from an expanding order book, PEC contract, new rig investments, and a promising bidding pipeline; the Dolphin Offshore acquisition unlocking offshore potential with higher revenue and margins; plans to expand their fleets; capitalizing on industry tailwinds boosting E&P and gas sector demand and competitive advantages like domain expertise, market leadership, and high barriers to entry ensuring sustained growth.

➢ We expect DIL’s Revenue/EBITDA/PAT to grow at a 28.9%/35.3%/28.8% CAGR over FY25-FY28E.

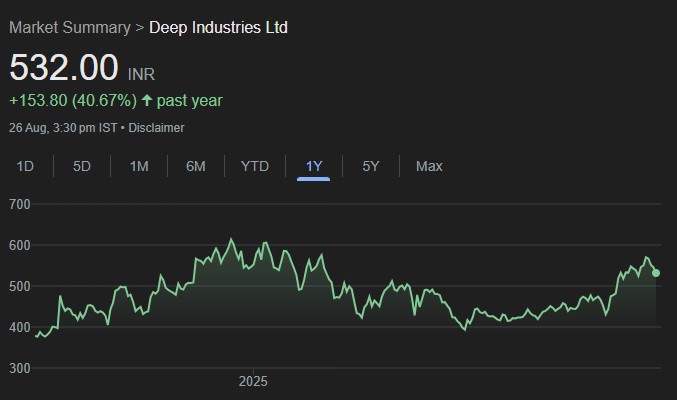

➢ We Initiate coverage on the stock with BUY rating and Sep’26 TP of Rs. 746 set at 15x H1FY28E EPS.

Robust Revenue Growth Outlook fueled by expanding Order Book , PEC Contract, New Rig Investments, and Promising Bidding Pipeline: Deep, with an order book of 3,051 crore as of August 2025 marked its 17th consecutive quarter of record growth continues to strengthen its position across segments. The recent foray into a new segment through a 1,402 crore PEC contract from ONGC is expected to drive incremental production from H2FY26, delivering margins above 40%. In the rigs segment, three rigs were deployed in Q4FY25, with three additional workover rigs on order to accelerate execution of the existing backlog. Steady growth from its gas processing and compression segment, combined with a 700+ crore active bidding pipeline, is set to further expand the order book. Backed by a targeted 30% annual revenue growth over the next 2–3 years and a planned capex of 300–350 crore primarily for new rigs and gas processing plants; the company expects standalone EBITDA margins to remain above 40%.

Acquisition of Dolphin Offshore Opens Offshore Growth Avenues; Barge Prabha and Fleet expansion plans to Drive Incremental Growth Beyond Standalone: Deep acquired Dolphin Offshore Enterprises in January 2023 for 27 crore via the IBC route, marking its entry into offshore oil & gas support services through barge Prabha and a JV tug. Post-refurbishment, Prabha secured a three-year lease from May 2025, delivering ~90 crore annual revenue at 90–95% margins, while a 37% JV anchor handling tug began operations in FY26 with daily revenue of USD 17,000–20,000 at ~50% margins. Supported by this solid base, Deep plans 400–500 crore capex in PSVs, DSVs, and additional tugs to scale its offshore footprint and boost long-term profitability.

Set to Capitalize on Industry Tailwinds from Government Policies Boosting exploration & production and Gas Sector Demand: India, the world’s third-largest oil and gas importer, aims to reduce oil imports to 50% by 2030 through enhanced domestic production. Initiatives like the Open Acreage Licensing Program (OALP) have opened over 1 million sq. km for E&P activities, benefiting Deep’s Drilling and Workover Services. The government plans $100 billion in E&P sector investments by 2030, providing expansion opportunities for Deep. Additionally, India’s push for a gas-based economy will drive demand for natural gas processing services, a core focus for Deep Industries.

Competitive edges, including extensive domain knowledge, market leadership, and high barriers to entry, to ensure sustained growth: Deep is uniquely positioned for sustained growth due to its over 30 years of domain expertise and leadership in the Gas Compression segment. The company offers a broad range of high-margin services, covering over 70% of post-exploration activities in the Oil & Gas value chain. Strong relationships with industry leaders like ONGC and Vedanta further solidify its position. Additionally, the capital-intensive nature of the industry and the need for specialized expertise create significant barriers to entry, reinforcing DIL’s market dominance and limiting competition.