Landing gear retracted; charting a steep trajectory

International expansion – a multifold opportunity

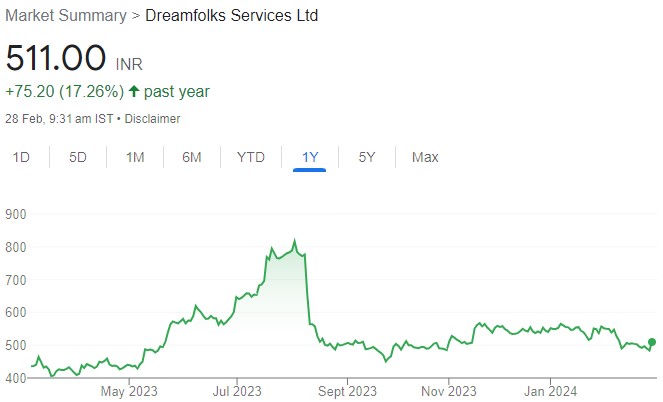

DreamFolks (DFS) is India’s leading airport services aggregator and tech platform, connecting lounges and premium airport facilities with users of bank credit/debit cards. DFS holds a 75%+ volume market share in domestic airport lounges and it is the only player with 100% coverage of airport lounges. DFS is the go-to partner for banks seeking to provide complimentary access to paid airport services lounge and this is a highly profitable and asset light model. We expect the company to benefit from the rapid growth in the Indian airline industry, driven by competitive fares, rising leisure travel, new airports, and government push. Further, the increasing adoption of bank card (with lounge access as a key benefit) is boosting the pay-per-use revenue model of DFS. This should help it deliver a strong 20% revenue/28% PAT CAGR over FY24E-26E, despite a high base, near-term setbacks due to revised airport charges, and a shift to the spending-based model. We see venturing into international markets as a lucrative long-term opportunity carrying significant potential value. We initiate coverage on the stock with a BUY rating at a TP of INR650, implying 34% potential upside.

Click here to download the research report on Dreamfolks by Motilal Oswal