Market Shifting Gears; Time to Build Long-Term Portfolio

On 23rd Nov’24, two state election results were due 1) Maharashtra and 2) Jharkhand. In a major comeback, the BJP-led Mahayuti alliance had won a whopping 230 seats out of 288 assembly seats in Maharashtra. However, in Jharkhand, the ruling party fell short in which NDA managed to secure only 24 spots out of 81 assembly seats. JMM-led India bloc managed to secure 56 seats. Nonetheless, Maharashtra is a key state related to market participants and this landslide victory in Maharashtra will be the biggest sentiment booster for the market. Six months back, the ruling alliance fell short of a majority. However, achieving a comeback in the latest assembly election within six months is indeed commendable. Maharashtra verdict will bring political stability for the next 5 years and is likely to boost investors’ confidence towards policy continuity going forward.

The tough phase of the market coming to an end: Oct’24 was a challenging month for the Indian equity market with broad-based correction witnessed across the market cap, styles, and sectors. The majority of the correction was led by 1) FII selling, 2) Lower-than-expected Q2FY25 earnings, 3) A rise in the US 10-year bond yields, and 4) Expectations of China recovery. The correction was further expanded to Nov’24 led by persistent FII selling and a rising dollar index. While Nifty 50 reached an alltime high of 26,216 on 26th Sep’24, the benchmark saw a correction of 11% from the top till 21st Nov’24. The broader market indices including Mid and Smallcap indices corrected by 10%/9% respectively. The impact of foreign outflow was higher in Largecaps compared to Small and Midcaps as they predominantly owned the Largecap counters.

After tepid H1, green shoots lie in H2FY25: Q2FY25 earning season posted a slightly weaker set of numbers which is translating into some moderation in the earnings momentum. 56% of the Nifty 50 companies either beat or were in line with the earnings expectation while 66% on the revenue front. This subdued performance was largely led by a slowdown in capex activities, some moderation in the urban consumption led by higher inflation and extended monsoon and a reduction in spread due to rationalization of the commodities prices. All these indicators impacted the margins of Indian corporates, which translated into earnings cuts. After Q2FY25, we saw an earnings cut of 1.5% for Nifty 50 companies for FY25 while the earnings cut for consensus was more than 3%. Now we foresee, Nifty 50 EPS to grow by 7.6%/13.7% in FY25/26 respectively.

In FY27, we expect earnings to grow by 11%. We foresee Nifty earnings growth of 14% CAGR from FY23-27. Based on the current economic momentum, stable political regime, capex and other infra agenda, we believe this double-digit earnings growth to be achievable in the next 2-3 years. All eyes are now on the earning recovery in H2FY25, which will be based on 1) The expectation of an increase in government CAPEX, 2) Post-monsoon activities, 3) A good number of wedding days, and 4) The expectation of rural pick-up in the second half.

What Could Happen on Monday?

• “Feel good” factor for the market on expectations of Policy continuity and expectations of a continuation of reforms in the second half

• The market could open on gap-up with an overall reduction in the volatility

• Short covering could be expected on Monday

• Based on this, the market positioning is likely to be towards the broader market with more PSU stocks in focus

• We believe, a portion of capital is sitting in a sideline across the board, which could come to the market on an immediate basis

• Sectors likely to be in the limelight: Private Capex, PSU stocks, Infra, Railways, Defense, Manufacturing, Real Estate, Green Energy, Power and Utilities

• 34 out of 55 PSU stocks in the NSE 500 universe are corrected by more than 30% from their 52- week high. In the coming days, we could see some amount of recovery in selective counters in Defence, Railways, Utilities, and PSU banks

Time to Act now! – After the recent correction, we believe the market is in the oversold zone. The number of stocks trading above 200 day day-moving average in the NSE 500 universe is hovering around 38% and the long-term average is 55%. Two months back, this number was hovering around 85-90%, typically indicating the overbought territory of the market. In the last 40-50 days, the market saw the journey from overbought to oversold. On top of that, currently, more than 60% of the NSE 500 universe is corrected by more than 20% from a respective 52-week high, indicating all the negatives are in the price. With this correction, valuations are also reasonable for the market. We believe this is the best time to Act Now and shift gears to build a long-term portfolio. We believe the much-awaited correction has already happened and most of the stocks are available at reasonable valuations as compared to what was available three months back. We recommend building positions in two themes ‘Growth at a Reasonable Price’ and ‘Quality’ to generate satisfactory results in the next one year.

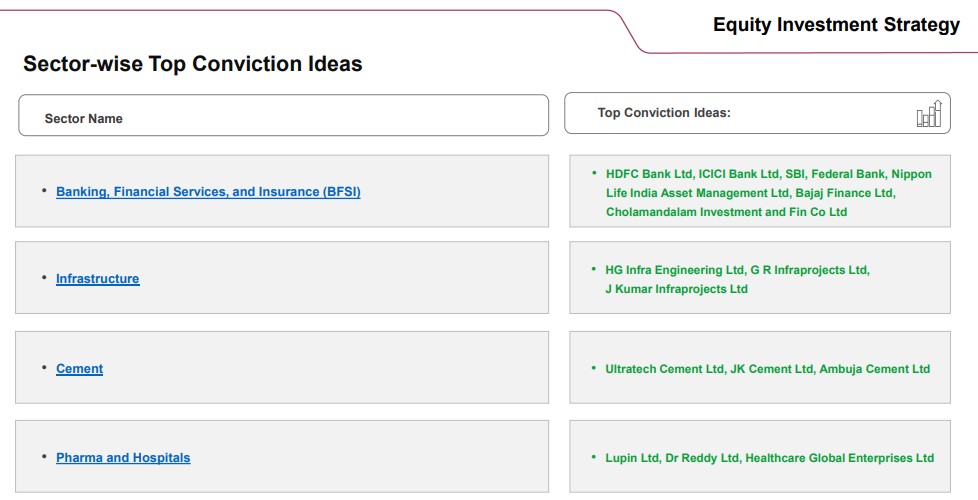

Based on the recent development, we are presenting Sector-wise Top Conviction Ideas

• Banking, Financial Services, and Insurance (BFSI)

• HDFC Bank Ltd, ICICI Bank Ltd, SBI, Federal Bank, Nippon

Life India Asset Management Ltd, Bajaj Finance Ltd, Cholamandalam Investment and Fin Co Ltd

• Infrastructure • HG Infra Engineering Ltd, G R Infraprojects Ltd, J Kumar Infraprojects Ltd

• Cement • Ultratech Cement Ltd, JK Cement Ltd, Ambuja Cement Ltd

• Pharma and Hospitals • Lupin Ltd, Dr Reddy Ltd, Healthcare Global Enterprises Ltd

• Fast-Moving Consumer Goods (FMCG) • Varun Beverages Ltd, DOMs Industries Ltd

• Retail • Trent Ltd, Ethos Ltd

• Chemicals and Midcaps • PI Industries Ltd, Dhanuka Agritech Ltd, Pitti Engineering Ltd, Gravita India Ltd, Va Tech Wabag Ltd

• Metal & Mining • Hindalco, Coal India, APL Apollo tubes, Tata Steel

• Power and Transmission • Inox Wind, Skipper limited

• Automobiles • Hero Motocorp, Sansera Engineering

• Information Technology (IT) & Telecom • HCL Tech, Bharti Airtel