Till recently, Warren Buffett held the exalted title of “World’s Greatest Investor” for his incredible investing skills. He was dethroned from the position recently by Billionaire Carl Icahn. This is because while Warren Buffett compounded his wealth at a CAGR of 19.5% since 1968, Carl Icahn compounded his wealth at 31%.

The difference in the two figures is enormous. A sum of Rs. 1,000 invested with Warren Buffett in 1968 would be worth Rs.50 lakhs today while the same amount invested with Carl Icahn would be worth Rs. 40 crore.

Warren Buffett also got dethroned from the position of “World’s third richest man” by Jeff Bezos of Amazon. Jeff Bezos pocketed USD 65.3 billion even while the octogenarian Billionaire had to stay content with a net worth of USD 64.9 billion.

Now, the latest embarrassment that Warren Buffett has to endure is that the humble Indian mutual funds have out-performed his track record.

This sensational revelation has been made by Sachin P. Mampatta of Mint.

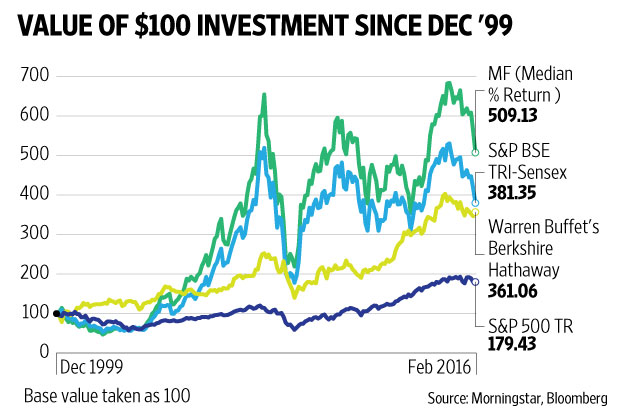

Mampatta points out that a million dollars invested with the Oracle of Omaha at the turn of the millennium would be worth an additional $2.6 million by the end of 2015. However, if the same sum was invested in an average mutual fund in India, the investor would be richer by over $4 million.

(Image Credit: Mint)

Mampatta has done a lot of number-crunching to support his analysis. He has not only looked at the “total returns over a 15-year period” but also considered the “one-year rolling returns”. He has also taken into account the “Alpha” of the mutual funds i.e. the excess returns that a fund returns over its benchmark on a risk-adjusted basis.

Whichever way one looks at it, it is clear that Indian mutual funds are the winner, Mampatta says with obvious pride in his voice.

The gratifying aspect is that the out-performance is not confined to the whiz-kid mutual fund managers but even average Raju sort of fund managers have put in an impressive performance.

Mampatta has credited the out-performance of the mutual funds to the “enormous tailwind of a soaring equity market, coupled with smaller asset size and market inefficiencies associated with an emerging nation”.

Several experts rushed to defend Warren Buffett on the basis that he is “hamstrung by the size and the maturity of the markets and economy in which he operates”. However, Mampatta has countered this by arguing that Warren enjoys several benefits that mutual funds don’t have access to, such as billions of dollars of insurance float money, the use of derivatives etc.

The bottom line of Mampatta’s analysis is that if we adopt the techniques of investment taught to us by Warren Buffett and apply it to the Indian context, we will be able to generate returns that will surpass those of Warren Buffett. This will please the Sage of Nebraska more than anything else!

So WB should invest in Indian MF to bolster the fortunes of BH

People Forgot that Buffet has given away $ 26 billion in last 5 years which others have not. And timing has been chosen for last 15 years . India has the tail winds. They should have compared the 1965-1985 period when America had the tailwind. Not a Buffet fan but one must compare apples to apples.

Nifty Eyes 8800 with Expected Passage of GST Bill

Stock Market Today by Shailesh Saraf – 1st August 2016

Indian Market Outlook:

Nifty benchmark index was positive last week on expectation of passage of GST bill as well as positive global cues. Nifty spot is currently facing stiff resistance between 8640-8680, however, with strong FII flows it is expected that the level should be crossed and 8800 mark is on the cards by the GST passage. Caution should be kept in mind that this rally has continued since last 5 months and once GST is passed correction can set in.

Top 5 gainers were Eicher Motor, Adani Port, Zee Entertainment Ltd, Lupin and Tata Power.

This is the most idiotic post I have ever read. Whosoever has written this doesn’t have an iota of knowledge about investing. American markets are evolved market where price discovery is easier, hence difficult to find bargains. Therefore, WB has done a very good job. Thinking it is a shame for him to lag behind somebody is foolish to say the least. In Indian market, anomalies are in large number hence the opportunity. If you have guts then post this message.

#Nivezareview :: Comparing any two analysts is never a fair. Strategies vary analyst to analyst. After calculating the results its is easy to say that mutual funds have out performed ace investor Warren Buffett but during 1968, it was difficult to ignore Buffett’s strategies as well. In stock market, it is really difficult to tell that who is going to drive the market. It is difficult to set some algorithm for the market conditions as well. Some how it could be easy to set some long term strategies with clearly defined goals.

Multibagger Stock Ideas

with inflation in the range of -1 to 2 in US and 8 to 10 in india buffet outperformed indian mutual funds by wide margins. Dont compare apples with oranges.