Fineotex Chemicals is a small-cap company with a market capitalisation of Rs 4370 crore and a free-float of Rs 1530 crore. The promoters hold 65.03% of the equity capital while the public holds 34.97%. Amongst the public, Ashish Kacholia holds 31,35,568 shares in his portfolio constituting 2.83% of the equity capital. Another HNI named SURESH KUMAR AGARWAL holds 14,00,000 shares constituting 1.26% of the equity capital.

Amongst Mutual Funds, NIPPON INDIA SMALL CAP FUND holds 40,41,828 shares constituting 3.65% of the equity capital.

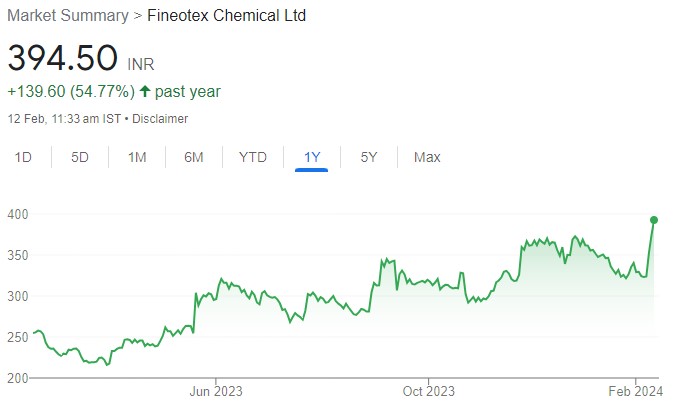

KR Choksey has issued an initiating coverage report on Fineotex Chemicals in which it has recommended a buy for the target price of Rs 531 which is an upside of 42% from the CMP of Rs 374.

The salient parts of the initiating coverage report reads as follows:

• Fineotex Chemicals Limited (FCL) is a chemicals manufacturer operating in 3 segments: Textile Chemicals, Cleaning & Hygiene, Oil & Gas.

• The company operates 3 facilities: Ambernath, Mahape & Malaysia with a total installed capacity of 104,000 MTPA, capacity utilization @ 68% for Q2FY24.

• While the company captures the entire value chain for textile chemicals, focus is on the finishing process. Finishing chemicals have the higher margins and customer stickiness.

• FCL works with key clients like Vardhman, Chenab Textile Mills, Welspun India, Only Vimal, Raymond, among others.

• The cleaning & hygiene segment was launched 4 years ago and contributes to 56% of volumes and 41% of revenues for Q2FY24, this segment is poised for future growth with growing products like mosquito repellents, detergents, floor cleaners.

• FCL has spent INR 350 MN through it’s a new wholly owned subsidiary FSPL Specialties Private Limited on 30th December 2023 for purchase of 7 acres of land, the land will be used to further expand manufacturing capacity.

Outlook & Valuation

FCL has showcased a strong track record of growth in revenues with 3 year Revenue CAGR of 38% as on FY23 supported by robust margins, average 5 year PAT margins coming in at 15% as on FY23. FCL is a growing specialty chemical manufacturer with international strategic partnerships with Eurodye-CTC, Belgium & HealthGuard Australia which will drive further growth opportunities for the company both in India & abroad. The upcoming addition to its manufacturing capacity will add a strong base for generating future growth, management’s tight control over working capital cycle and margins will ensure good earnings growth going forward.

Currently, FCL is trading at a 35.2x/27.2x forward P/E for FY25E and FY26E, we remain optimistic on the prospects of the company and assign a P/E of 30x and initiate our coverage with a target price of 531.

Click here to download Fineotex Chemicals IC report by KRChoksey