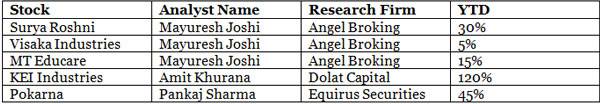

Kshitij Anand of ET has spoken to leading experts like Vineet Bhatnagar, Mayuresh Joshi, Amit Khurana and Pankaj Sharma and collated their top five stock ideas:

(1) Surya Roshni:

Surya Roshni is something that we like, because of governments recent push to sell LED bulbs. The lighting industry should do pretty well. Within that, the LED segment should contribute 30% over the next couple of years. Fans and other appliances have been doing well, and we expect them to hit that Rs 200 crore odd market respectively. Again, the steel business has been a drag, but clearly the lighting business is performing very well and the debt levels have actually come down by Rs 65-odd crore in the first half itself. The stock valuation at 7.5 times looks pretty attractive to us at the current juncture.

(2) Visaka Industries:

Visaka Industries is more of a smallcap play. But, if you look at their asbestos cement products division that has not been performing well, but the expectation is that in the next two years with a 70% market share it should do reasonably better. The division has done exceedingly well. Their synthetic yarn division has done well. So, Visaka Industries on decline is something that long-term investors can look at.

(3) MT Educare:

This stock is one of the top ones in the education space. The kind of top line growth that one really expects of 27% over the next two years should suffice, because the kind of pre-university tie-ups that it is doing, the robomate division, the learning management solution division, all these divisions are expected to perform well. Taking into account all the above factors, it will translate into a bottom line growth of at least 20 per cent over the next couple of years. So, valuations are looking attractive for MT Educare even at the current level. One can look at the stock with the target of 170 over the next 12 months.

(4) KEI Industries:

KEI Industries story is more structural. One of the reasons the stock looks like a potential bet is because that there are two constructs around the whole argument for us for KEI. First, there is a significant opportunity building up in the EHV space which is the extra high voltage space, wherein they are one of the only two other Indian manufacturers who have the capability and the eligibility to bid for the tenders.

This is a market which is primarily an import substitute, and we are looking at about market size of close to about $250 million growing at about 15-20%. An investment into the transmission and the distribution side will help the company to capture smart city projects and whole lot of other initiatives at the state government level. The second key argument is that, there has been a significant retail push which now stands at 30% from about 15-20% earlier. It might seem more like a lower margin business, because of the working capital issues which is not the case here.

It is more like a cash and carry kind of a structure that they follow, and therefore we believe that the ability to brand that and capture market share over a period of time will help them neutralise the other businesses which are lower margin.

(5) Pokarna:

It is a company which is still plying below the radar of many investors, because it was not very big. It is still quite small, but if you look at the business they are in, it is remarkable. The business is related with the export theme. The granite which is used as kitchen marble, they export to US and also if you look at the certification which are required to supply that kind of a commodity to these countries.

It is very-very stringent and very -very difficult to get, and also in terms of various other certification and regulation which are in place, this is a company which has done that part very-very well.

Looking at the core business they are in, they are one of the market leaders, and also they have been very-very successful in getting all the regulatory things in place.

MT Educare holds good potential over the medium to long term. Asset light model. Good return ratios. Well managed business. Buy.