2026: A Better Setup for Earnings Revival Compared to The Last Year

2025 in retrospect: The past year was a challenging year for the Indian equity market, with the Indian market underperforming global and emerging markets for the first time since the Covid-19 era. Even with underperformance vs other global markets, our benchmark index Nifty 50 crossing 26,000 milestone after 15 months of consolidations (earlier high was 26,217 on 26th Sep’24). In 2025, the broader market lagged, as the Nifty 50 rose by 10.5% while the Nifty Smallcap 250 fell by 5.6%. The past year tested investor resilience through sharp market rotations, currency volatility, global trade uncertainty, and intermittent foreign capital outflows. Despite all these challenges in the global economy, global equities have delivered strong returns in 2025, supported by AI-led growth themes and policy easing. Safe haven assets like Gold have given staller performance, led by trade uncertainty and major central banks’ buying.

On the domestic front, Indian investors demonstrated a proactive and unwavering belief in India’s long-term growth narrative. This faith has been bolstered even more in the last one year, with Domestic investors (DIIs) injecting $88.8 Bn into the Indian equity market while Foreign Institutional Investors (FIIs) taking out $18.7 Bn over the same period. Additionally, the monthly Systematic Investment Plan (SIP) inflow in mutual funds has surged to over Rs 29,000 Cr in Sep’25. This reflects a structural shift in the Indian equity market — from a reliance on FII inflows to a foundation increasingly supported by strong domestic participation. The growing dominance of domestic inflows underscores the deepening maturity of India’s investor base and highlights their unwavering confidence in the country’s long-term growth trajectory.

Indian Economy on the verge of cyclical recovery; however, Global Challenges Likely to Persist: Despite external risks, India’s domestic growth trajectory remains intact, with key macroeconomic factors supporting a stronger FY26 compared to FY25. Both the RBI and the government are providing support by front-loading all pro-growth fiscal and monetary measures to the Indian economy. These developments collectively indicate that our economy is at an inflexion point and will gain benefits in the second half and onwards. All these factors indicate an even better FY27 vs FY26. As we enter CY26, Indian equity markets are transitioning from consolidation to one increasingly driven by earnings visibility, valuation comfort, fiscal discipline, and growth sustainability. However, a key overhang for markets over the past year has been India–US trade and tariff-related uncertainty, which temporarily weighed on export-oriented sectors and foreign investor sentiment. Nonetheless, recent developments indicate progress toward resolution and normalization, reducing tail risks and improving visibility for India’s external trade outlook. A gradual easing of global financial conditions, coupled with stabilizing bond yields, is also expected to improve capital flow dynamics into emerging markets, including India.

Relative Underperformance Provides an Opportunity to Add Equity for the Long Term: In 2025, the Indian market has underperformed the US market and other emerging markets by a notable margin. FTSE India is now trading at a PE premium of 55% to the EM index (PE), vs. an average premium of 44%. During Sep’24, the Indian market traded at a 97% PE premium to EM. And now, after the correction, it is trading at a 55% premium, which looks attractive compared to the past. That said, it is to be noted that relative valuation stabilisation does not necessarily translate into an immediate rally in the current scenario. Markets, in addition to various other developments, are expected to track the following four key parameters: 1) Progress on US trade negotiations, 2) Revival of the earnings growth cycle, which is likely to start from Q3FY26 onwards, 3) Revival in a credit growth cycle, and 4) Transmission of fiscal and monetary benefits into consumption growth.

Style & Sector Rotation – A Key to Generating Alpha Moving Forward: RiskReward is slowly building towards Mid and Smallcaps. Nonetheless, recovery will be slow and gradual as we progress in 2026, led by strong earnings expectations, improving domestic liquidity, and stable Indian macros. We believe the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. As a result, we expect near-term consolidation in the market, with breadth likely remaining narrow in the immediate term. Against this backdrop, our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders in their respective domains, and domestically-focused sectors and stocks. These, we believe, may outperform the market in the near term. Based on the current developments, we 1) Continue to like and overweight BFSI, Telecom, Consumption, Hospitals, and Interest-rate proxies, 2) Continue to maintain positive view on Discretionary and Retail consumption plays, 3) Prefer certain capex-oriented cyclical plays that look attractive at this point due to the recent price correction as well as reasonable growth visibility in the domestic market in FY26, and 4) Maintain cautious stance on export-oriented sector due to tariff overhang and macroeconomic uncertainties.

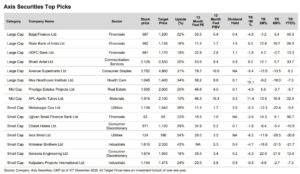

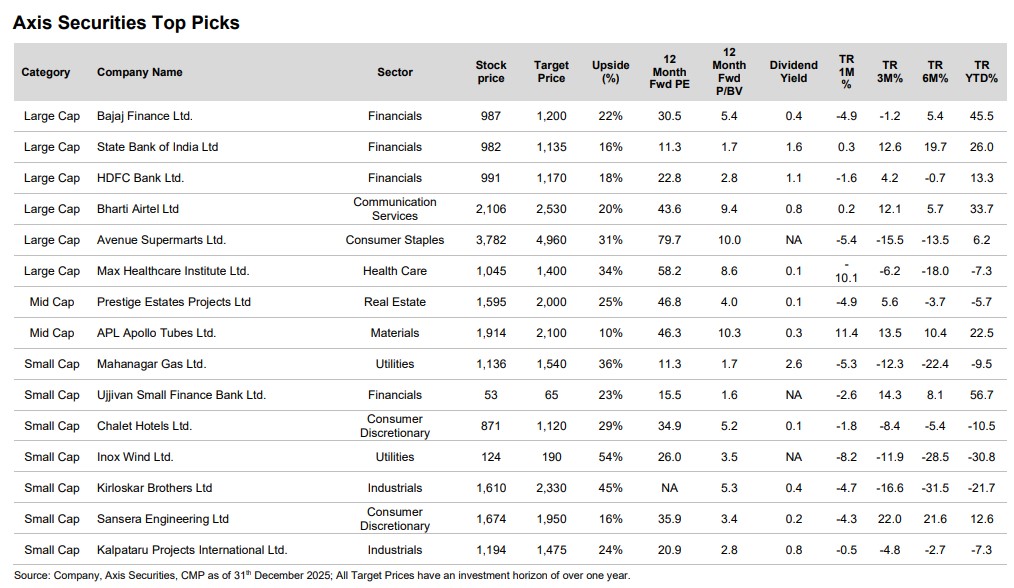

We maintain our Top Picks recommendations unchanged for the month as we continue to focus on the thematic approach of superior-quality companies

Based on the above themes, we recommend the following stocks: HDFC Bank, Bajaj Finance, Bharti Airtel, Avenue Supermarts, State Bank of India, Max Healthcare, Kirloskar Brothers, Kalpataru Projects, APL Apollo Tubes, Mahanagar Gas, Inox Wind, Prestige Estates, Ujjivan Small Finance Bank, Chalet Hotels, and Sansera Engineering