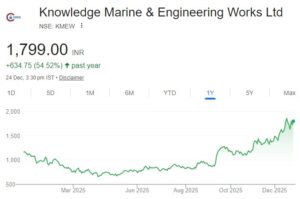

Marquee integrated maritime player

India’s maritime industry is at an inflection point with unprecedented emphasis on infrastructure creation and inland waterways. KMEW enjoys a ~50% order-win rate amid scarce competition and high entry barriers, delivers superior 35–40% EBITDA margin and is diversified across the spectrum of dredging/shipbuilding/ancillary services accounting for 43%/11%/46% of the balance order book.

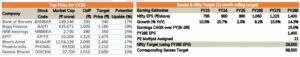

Nov-25 OB (at INR17.5bn; 8.7x FY25 sales) is up ~2x YoY with orders from major ports, IWAI, DCI and ~INR6.5bn OI for green tugs (GTTP). We are baking in FY25–28E revenue/EBITDA/PAT CAGR of 58%/62%/71% with FY25–28E OI and OB CAGR at 42% each. Initiate at ‘BUY’ with a TP of INR2,500 at 25x FY28E EPS of INR100.

Integrated and diversified marine services platform

Knowledge Marine & Engineering Works (KMEW) is diversified across the spectrum of dredging/shipbuilding/ancillary services forming 43%/11%/46% of balance OB. It also participates in the full lifecycle of port and inland waterway infrastructure. KMEW has diversified across geographies (Myanmar—two orders executed) and Bahrain (currently on hold). Its expertise in capital/maintenance dredging, in-house construction and diversified fleet have built strong credentials with major ports, IWAI and DCI while green tugs and Narmada Voyage Cruise provide long-term annuity visibility with Nov-25 OB at INR17.5bn (up 2x YoY; 8.7x FY25 sales).

High entry barriers and strong win-rate to drive growth

The Indian dredging industry has stringent pre-qualification norms on execution track record, revenue thresholds and bid size, limiting competition and creating a favourable landscape for KMEW. Given 20-plus years of seabed data and technical expertise, it has independent bidding capability for INR3bn-plus with ~50% order win-rate, expanding in ports, rivers, national waterways and DCI subcontracting (FY25 OI: ~INR1bn from nil in FY23). Nov-25 OB is INR17.5bn (8.7x FY25 sales, up 2x YoY) across major ports/IWAI (NW-1 OB: INR2.7bn)/DCI and ~INR6.5bn OI for green tugs (GTTP—2/6 tenders won and ten more by 2027 with strong OI potential).

Margin resilience with Tonnage Tax Scheme to aid PAT

KMEW is eyeing 35%+ OPM while bidding with a proven OPM (FY25 margin: 39%, FY25 PAT margin: 25%) showing. Applicability of Tonnage Tax Scheme cuts tax outgo, aiding PAT expansion (FY28E PAT margin: 30%+). We are baking in FY25–28E PAT CAGR of 71%. KMEW trades at a compelling 17.3x FY28E EPS (INR100) with EPS CAGR of 63% and RoE/RoCE to rebound to 30%/24% after FY26–28E capex [INR7.5bn funded by INR2.85bn raise (in Q3FY26) + robust balance sheet with FY28 net D/E of 0.24x]. De-risked, multi-year visibility from a diversified order book, high entry barriers and large TAMs with strong order inflow visibility warrant a premium multiple. Initiate at ‘BUY’ with a TP of INR2,500 at 25x FY28E EPS of INR100. Key Risks: i) new ventures; ii) weather and policy dependent; iii) international/geopolitical exposure; and iv) historical delay in executing OB/OI.