Antolin acquisition hastens diversification; rerating on the cards

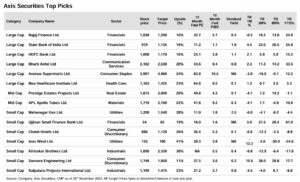

Shriram Pistons & Rings (SPRL) has announced the acquisition of 100% stake in Grupo Antolin’s three India entities (Link to press release) at ~Rs16.7bn EV. The entities logged Rs11.8bn revenue in FY25, operating across aesthetic and styling-linked products like interiors, headliners, lighting modules, door trims, consoles, ambient lighting, and soft-trim systems, and supplying to leading PV OEMs such as Tata Motors, M&M, and Volkswagen; the (global) parent caters to OEMs like Alfa Romeo, Ferrari, Aston Martin, and Bentley. Strategically, the acquisition accelerates SPRL’s diversification into engine-agnostic components (nil in FY23 vs 15% revenue share after the 3 strategic acquisitions earlier vs 36% by FY27E/FY28E after full consolidation), creating strong adjacencies with its existing plastics businesses (Takahata + TPGEL). While FY26E PAT would see a modest temporary drag (-4%) from lower other income (cash utilization) and higher interest, the acquisition drives a >30% upgrade in FY27E/28E topline and a ~3-7% upgrade in EPS by FY27E/28E, led by scale-up and customer diversification of the Antolin portfolio. SPRL trades at ~16x Sep-27E PER (at ~57% discount to peers) despite a healthy revenue/EBITDA/EPS CAGR of ~26%/23%/23% over FY26E–28E (including the Antolin India acquisition) and improving RoCE trajectory (~24% by FY28E vs 17% in FY22). With accelerating diversification into the non-ICE portfolio and sustaining strong growth/profitability in the core ICE portfolio, we raise our target multiple to 25x (from 20x), which translates into a ~37% TP upgrade to Rs4,650 on rollforward basis to Dec-27E (vs earlier Sep-27E TP of Rs3,400). SPRL will hosted a call on 9-Dec, coming Tuesday (Link) for further discussion on the transaction.

Antolin acquired at an attractive valuation; diversification engine to start firing SPRL has announced acquisition of 100% stake in Grupo Antolin’s three India entities, ie T1 – Antolin Lighting India Private Limited; T2 – Grupo Antolin India Private Limited; T3 – Grupo Antolin Chakan Private Limited, a wholly owned subsidiary of T2 (Press Release Link) for an EV of ~Rs16.7bn. Key clients of SPRL’s India group include OEMs like Tata Motors, M&M, and Skoda Volkswagen. Moreover, SPRL will enter a TLA with the global parent, ensuring ongoing access to advanced interior technology and design capability. At face value, SPRL’s acquisition of Grupo Antolin’s India business brings a sizable (~33% of SPRL’s consolidated revenue) Rs11.8bn revenue-generating (T1+T2+T3) franchise into its fold. The financial aspect of the deal also appears attractive. The acquisition is priced 1.4× FY25 EV/Sales and ~15.5× FY25 EV/EBITDA – reasonable for a business that delivered EBITDAM of ~9% in FY24. Moreover, the sale closely aligns with its global outlook (refer to the 2023 Integrated Report; Link), per which the global parent has clearly mentioned that it will continue divesting non-core assets, reducing leverage, and optimizing its global footprint. The global transformation plan includes €150mn divestments (CY24–25) and we believe the India sale is directly aligned with this strategy, given its relatively small size (~2.7% of global revenue as of CY24).