Electronics Powering India’s Defence Upcycle

The global defence sector has entered a structurally elevated growth phase, driven by persistent geopolitical conflicts, rapid technological modernization of weapons, and a multi-domain warfare. Global military expenditure surged at ~8.6% CAGR in the past three years as against a long-term average of ~4%. Countries are accelerating modernization across missile defence, UAVs, space systems, and electronic warfare. India, as a fourth largest defence spender in the world, stands at the center of this transformation. The country is transitioning decisively from being a major importer to building an indigenous defence industrial ecosystem. This shift is reinforced by the natural obsolescence of aging military assets and an unequivocal sovereign mandate for self-reliance. In our view, this will result in a sustained, technology-intensive capex super cycle for domestic defence industry, benefitting companies with high electronics content products, in line with the global trend. Domestic catalysts powering growth:

▪ Government policy support: Through policies such as DAP-2020, iDEX, SRIJAN, defence corridors (UP/TN), DPEPP-2020, TPCR-25, higher FDI, and import ban, domestic ecosystem building is being supported.

▪ Large indigenous programs: Key defence programs such as LCA Tejas Mk1A, Mk2, AMCA, QRSAM, Project Kusha, and P-75(I) provide long-term visibility of growth for the companies.

▪ Expanding MSME ecosystem: Rapid scaling of private players producing electronics, radars, UAVs, and avionics helps in the development of domestic industrial ecosystem.

Investment thesis

▪ Strategic moats: Barriers to entry are reinforced by deep tech collaborations with the DRDO and a clear government preference for domestic contract winners, creating a protected competitive landscape.

▪ Multidecadal visibility: Elevated orderbook to sales ratios, led by a large pipeline of complex platforms, ensure long-term revenue predictability.

▪ Margin expansion: The indigenization mandate is no longer just a policy tailwind; it is a margin expansion catalyst. Through localization of subsystems, and spares, integrators are capturing higher value-addition.

▪ Export-led scalability: Beyond domestic replacement, India is emerging as a cost competitive global hub. Exporting complete platforms (e.g., Akash, BrahMos, etc.) to friendly nations is a massive growth opportunity.

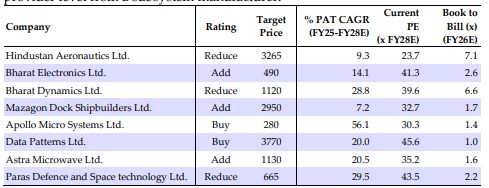

We believe that the expected sector growth trajectory offers a multi-year compounding story, combining sustained order inflows and efficient execution. We maintain a positive outlook on the sector and initiate coverage on eight companies (listed in table below). We prefer electronics value chain players and companies with proven technological capabilities to transition to a full solutions provider level from a subsystem manufacturer.