Proxy for compounding global data center demand

MTAR Technologies (MTARTECH) is a precision engineering company serving niche, high-barrier industries across defense, aerospace, nuclear energy, and clean energy with a growing exposure to global fuel cell technology through its decade long partnership with Bloom Energy (BE).

MTARTECH is firmly positioning itself as the indirect beneficiary of the global AI infrastructure wave. The world is building data centers at an unforeseen pace, i.e., ~100 GW of new capacity is expected during 2026-2030 (14-18% CAGR), and the singular challenge holding this expansion back is not capital but reliable power. Grid connections now take 2-5 years; AI cannot wait that long.

This is precisely where BE steps in. Its solid oxide fuel cell (SOFC) technology deploys 50-100 MW of power in just 90-120 days with five-nines reliability — a speed advantage that has made it the preferred power partner for some of the world’s largest hyperscalers and utilities. A USD20b order backlog and partnerships with Brookfield, AEP, Oracle, and Equinix reflect the growing confidence in BE’s proposition. With manufacturing capacity set to double to 2GW by CY26 from 1 GW in CY25 and further to 4 GW by CY28, BE’s growth trajectory appears well-supported.

What makes MTARTECH particularly interesting is its structural position within BE’s supply chain. As the sole supplier of critical hot box assemblies (meeting 60-70% of BE’s requirements), built over a decade of collaboration, MTARTECH’s relationship with BE is both deep-rooted and difficult to displace. This is already reflecting in its financials; 3QFY26 order inflows reached a record INR13.7b, up 5.1x YoY, with nearly half of them sourced from BE. Our analysis suggests that for every 1 GW of orders BE secures, MTARTECH stands to receive INR9-11b, translating to INR27-53b in potential cumulative inflows over the next 3-5 years (on the back of 3-5GW of order inflow for BE).

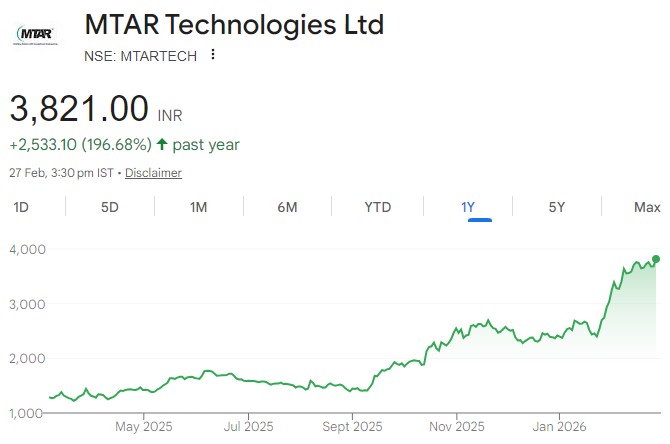

We expect MTARTECH to post a CAGR of 40%/55%/78% in revenue/EBITDA/ adj. PAT over FY25-28. We reiterate our BUY rating on the stock with a TP of INR4,810 (50x FY28E EPS i.e. ~0.6x PEG on FY25-28E EPS CAGR).