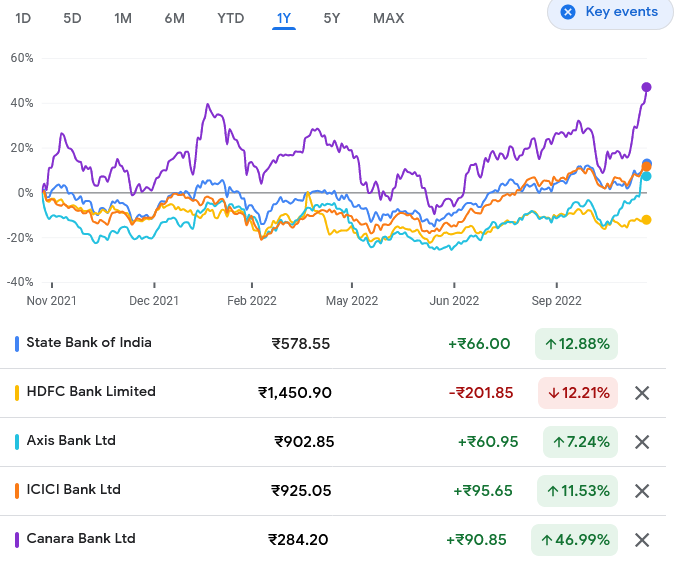

It is a Marathon. Underperformers like HDFC Bank will catch up soon

The acute underperformance of the erstwhile star stocks like HDFC and HDFC Bank is causing anxiety amongst the eminent intellectuals of Dalal Street.

Saurabh Mukherjea recently issued a detailed note explaining the reasons for the underperformance of HDFC Bank vis-à-vis its peers like SBI. He has assured that this is a temporary phase and that the price performance will soon catch up with the fundamentals (link)

Hiren Ved expressed a similar opinion. “There is no doubt that the banking story is intact and they are still good to go for the next year”.

“To your question on HDFC, HDFC Bank or the others, which have not done well in financial services, remember it is a marathon. There are a few who have gotten to a great start, there are a few who are running at a steady speed and maybe they will pick up at some point in time,” he asserted.

HDFC Bank is lagging on the Digital experience & is losing customers

It is well known that HDFC Bank goofed up badly on its technical infrastructure and had frequent outages. In fact, the situation became so bad that the RBI had to step in and issue an embargo on the launch of new products till the Bank gets its act in order (link).

Hiren pointed out that digital capabilities are as important as the traditional issues of credit capabilities, liability franchise, asset mix, yield, quality of the management, etc.

“Everything happens on an app. If you cannot give a great digital experience to a consumer, you are likely to lose a few customers. Some of the bigger franchises today are struggling a little bit and maybe the markets are taking cognisance of it,” he stated.

Top three holdings are financial stocks. Top 10 include manufacturing, Defence, Pharma etc

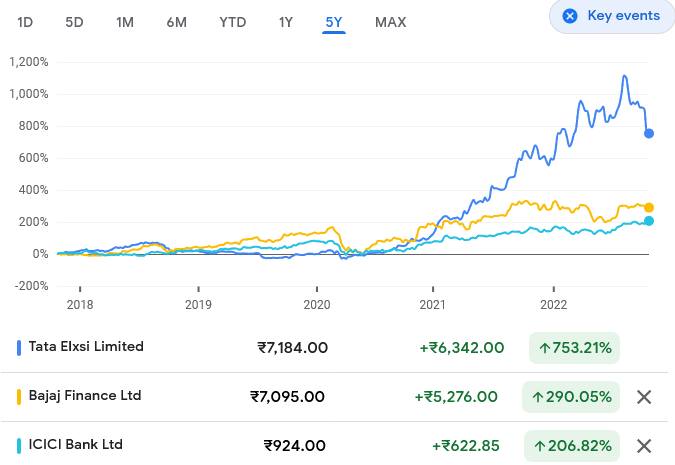

Hiren revealed that the top three stocks in his portfolio are Tata Elxsi, Bajaj Finance and ICICI Bank.

All three stocks are powerhouse multibaggers and have been recommended to us by Hiren a number of times in the past as well.

He opined that these stocks have a long way to go and are still good buys.

“One holds on to stocks for multi-year cycles unless one genuinely believes that either the external environment is completely changed or the hypothesis has turned on its head which has not happened, frankly,” he explained.

“Stocks become top not because of allocated cost but they also compound,” he added.

Portfolio Holdings of the ALCHEMY High Growth Select Stock

| Holding | % |

|---|---|

| TATA ELXSI LTD | 12.94 |

| BAJAJ FINANCE LTD | 8.22 |

| ICICI BANK LTD | 5.19 |

| DIVI’S LABORATORIES LTD | 4.59 |

| UNITED SPIRITS LTD | 4.01 |

| TATA CONSUMER PRODUCTS LTD | 3.51 |

| RELIANCE INDUSTRIES LTD | 3.43 |

| INFO EDGE (INDIA) LTD | 3.43 |

| DIXON TECHNOLOGIES (INDIA) LTD | 3.32 |

| VARUN BEVERAGES LTD | 2.99 |

| Top 10 Equity Holdings | 51.63 |

Portfolio Holdings of the Alchemy High Growth PMS

| Holding | % |

|---|---|

| ICICI BANK LTD | 7.95 |

| BAJAJ FINANCE LTD | 7.66 |

| PRAJ INDUSTRIES LTD | 7.03 |

| P I INDUSTRIES LTD | 6.56 |

| HDFC BANK LTD | 5.90 |

| AVENUE SUPERMARTS LTD | 4.94 |

| MARUTI SUZUKI INDIA LTD | 4.81 |

| DIVI’S LABORATORIES LTD | 4.64 |

| EICHER MOTORS LTD | 4.42 |

| TITAN COMPANY LTD | 4.32 |

| Top 10 Equity Holdings | 58.22 |

Source: pmsaifworld.com

India was a runner without shoes. Now, India is a runner with shoes and can run much faster

Hiren stated that India is becoming as great as America due to capital innovation and productivity. “Capital is available now across the world if there is a good idea and we will see a massive productivity cycle being unleashed in India. As we get out of Covid and activity levels jump, the real multiplier will be unleashed,” he said.

“Rakesh Jhunjhunwala used to say, India is a runner without shoes. I think now India is a runner which has shoes on and so can run much faster. Today manufacturing is a reality,” he added.

He also pointed out that Digitisation will help improve the working capital cycle because money can move faster. We are underestimating the power of productivity improvement because of the digitisation that we have done.

We are going to have a manufacturing renaissance in India

Hiren stated that he is very bullish about the manufacturing sector and they are a part of his top holdings.

“I genuinely think that we are going to have a manufacturing renaissance in this country. India has shown it. We created generic pharma champions in the mid ‘90s – Sun, Cipla, Ranbaxy- – which conquered the world. That is happening in specialty chemicals and in auto components. In two-wheelers, already some of our champions are selling 50-60% of their volumes globally,” he stated.

“There is now a greater realisation that one needs to build capacities or at least domestic capabilities in many areas and that is why, today one of the two large groups in this country are thinking of manufacturing semiconductors because if you want to be a leader in electric vehicles or in the new energy business, you have to have the supply chain in your control,” he added.

Hiren cited the names of several powerhouses such as Maruti, Bharat Electronics, Hindustan Aeronautics, Bharat Dynamics, Bharat Forge, Sundaram Fasteners etc which will prosper in the years to come.

“We have a great opportunity and we will have a lot of winners. Indian entrepreneurs are great,” he concluded.