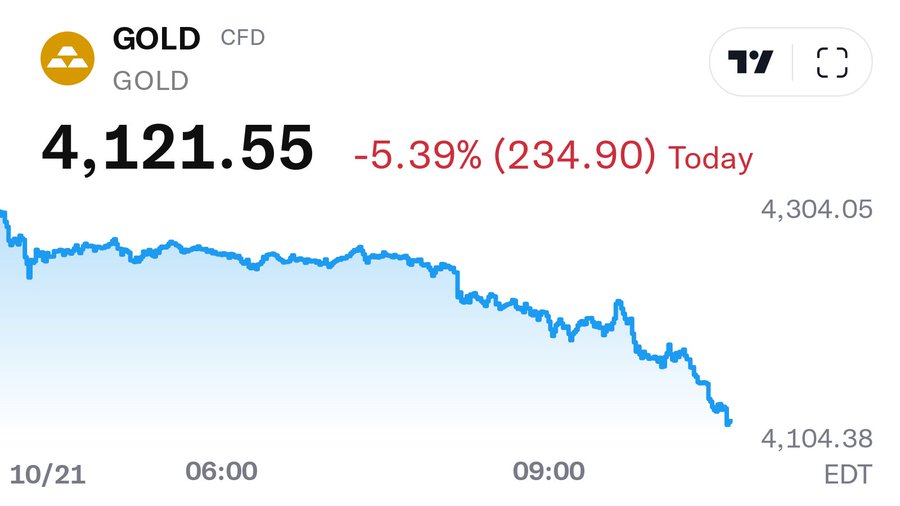

(October 21, 2025) — Gold prices extended losses on Tuesday, falling more than 5% to trade near $4,214.29 per ounce, as traders took profits following last week’s record highs above $4,400. The move marks one of the sharpest pullbacks in the precious metal this year, triggering broad volatility across the metals complex.

Spot silver also declined sharply, dropping more than 6%, while market participants described the selloff as a “shakeout” following a parabolic rally over the past three months.

Volatility After Record Highs

Economist and gold investor Peter Schiff said the current decline represents a temporary correction rather than a reversal of trend.

“Gold is now down over $200. Quite a shakeout, but all of this volatility is occurring with gold still above $4,100, which was a record high last week,” Schiff said in a post on X (formerly Twitter).

Schiff noted that Bitcoin appeared to be gaining from the selloff, calling it “another window for Bitcoiners to sell fool’s gold and buy the real thing.”

Gold prices have rallied strongly in recent months on expectations of lower real interest rates, geopolitical tensions, and ongoing central bank demand. However, analysts say the rapid ascent left the market vulnerable to profit-taking and margin-related liquidation.

Gold and silver stocks will get crushed on the open, a great time to buy. This volitility is just noise and it's actually irrelevent to mining company's profits, which will skyrocket depsite this morning's sharp sell off, even if it's not reversed, which it likely will be anyway.

— Peter Schiff (@PeterSchiff) October 21, 2025

Analyst Warns of Technical Risks

Technical analyst Christopher Aaron said the market’s rise of roughly $1,000 over the past three months could unwind significantly in the coming weeks.

“It could easily give 90% of that back within the next three weeks. There is zero support for gold on the chart until $3,435–$3,500,” Aaron said on X.

“Just because there is zero support does not mean I am short. Only a gambler shorts into a parabolic advance,” he added, noting that he had taken profits and was waiting for lower levels before re-entering.

Silver Sees Heavy Liquidation

Silver also saw outsized moves, with prices down more than 6% intraday. Traders described the selloff as “a scary shakeout,” adding that the move may be flushing out late buyers and allowing short positions to cover after weeks of losses.

Some investors said they expect the decline to be short-lived, citing tight supply conditions and rising industrial and monetary demand for silver.

“This selloff won’t last long,” one trader said. “Silver could be trading back at $53 towards day’s end if momentum returns.”

Market Perspective

Despite the steep losses, several analysts said the broader macro backdrop remains supportive for precious metals, pointing to central bank purchases, inflation concerns, and limited mine supply as longer-term bullish factors.

Volatility of this kind is typical during strong bull markets, analysts noted. “Sharp price declines are common during rallies,” one market strategist said. “These moves tend to shake out speculative positions before the trend resumes.”

At 14:30 GMT, spot gold was last down 4.9% at $4,214.29 per ounce, while silver traded near $51.20, down 6.3% on the session.