Foray into High Margin Value Added Products to drive growth!!!

Goodluck India Ltd. is among the leading manufacturer of wide range of Engineering structures, Precision/Auto Tubes, Forging for Defence & Aerospace, CR products and GI pipes. Established in 1986, the company has transformed itself from manufacturing regular steel products to a premier engineering solutions provider. The company has strategically shifted its focus on High Margin Value Added Products and High growth sectors such as Auto, Solar, Railways and Defence & Aerospace. Headquartered in Ghaziabad, the company has a manufacturing facility of 4,50,000 metric tonnes per annum (MTPA) situated in Sikandrabad (UP) and Kutch (Gujarat), India with a workforce of more than 4,000 employee strength. The company brings in a rich experience of 37+ years of industry presence with a demonstrated track record of innovation and engineering allowing it to cater marquee clients worldwide. Its diversified product portfolio has enabled the company to onboard over 600 customers and spread across 100 countries globally.

Going ahead, we believe Goodluck India Ltd has stellar growth potential due to (a) Foray into Hydraulic tubes business by successfully establishing a 50,000 metric tonnes (MTPA) facility with plans to double it to 1,00,000 MTPA in the future, along with (b) Successful establishment of high-margin defence business through its subsidiary for the manufacturing of artillery gun shells, (c) Healthy business relations with marquee clients across the public and private domain, (d) Anticipated expansion in EBITDA/tonne post stabilization of operations across the newly set up hydraulic tubes and defence & aerospace business, and (e) Positive demand outlook for solar torque tubes in the long run.

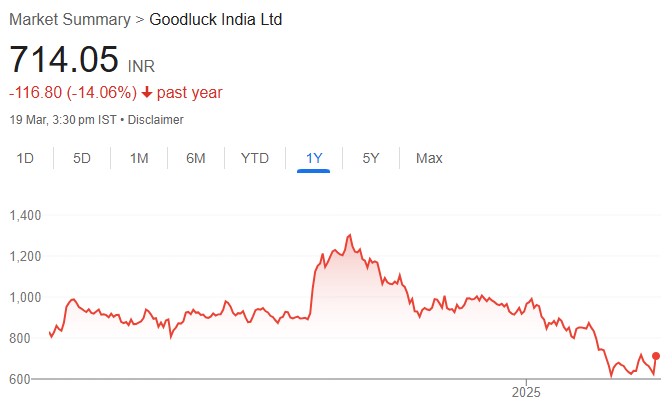

We expect Revenue/EBITDA/Net Profit to grow at a CAGR of 13.6%/18.1%/25.0% between FY24-FY26E to Rs.4,550 cr/Rs.394 cr/Rs.207 cr respectively. At a CMP of Rs 660, the stock is trading at 14.0x/10.5x P/E multiple based on expected EPS of Rs. 47.3/63.1 for FY25E/FY26E respectively. We have valued the business at 15x P/E multiple based on its FY26E earnings and arrive at a target price of Rs.947.0 thus providing an upside potential of 43.4% and assign a BUY rating for the stock.