Demand improving, expect growth to revive from H2FY26E; reiterate BUY!

We interacted with Mr. Manoj Tulsian – Joint MD & CEO and Mr. Sanjiv Keshri – CFO of GREENPLY INDUSTRIES Ltd to understand the ongoing trends and developments of the industry & company. Following are the key highlights from our interaction:

Plywood:

Demand for plywood segment is improving across regions.

Company is focusing on expanding the reach of the ECOTEC brand.

Timber prices are stable presently and management expects the same to cool-off from coming year.

Implementation of BIS norms are creating pressure on unorganized industry and management believes this will be a big boost for branded manufacturers.

The new plant at Odisha will be operational by FY27E end. Management believes with rebalancing activities done at current facilities, there will not be any capacity constraints to cater the upcoming demand.

Company believes the segment is well poised to capitalize on the upcoming demand and improve overall performance materially.

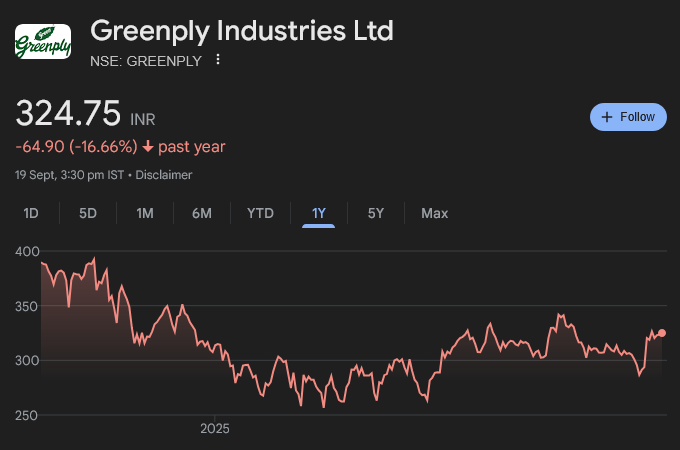

We reiterate GREENPLY INDUSTRIES LTD as our TOP-PICK from our coverage universe. We remain confident that company will register stellar growth over coming 2-years with improving industry tailwinds, steady plywood growth, ramp-up of MDF segment, and expected timber cost deflation. Hence, we factor-in Revenue/EBITDA/PAT growth of 13%/26%/55% over FY25 FY27E. We continue to value the company at P/E(x) of 25x on FY27E EPS of Rs18 and reiterate our BUY rating on the stock.