According to a report in Bloomberg, Amsterdam-based IMC Trading BV is offering interns in India up to 12.50 lakhs ($14,182) a month in 2025. This is triple what it paid in 2024. Rival Quadeye, one of India’s biggest recruiters in this space, is paying newcomers up to 750,000 rupees a month, a 50% jump from last year. For comparison, the average annual base pay for Indian finance professionals is about 700,000 rupees.

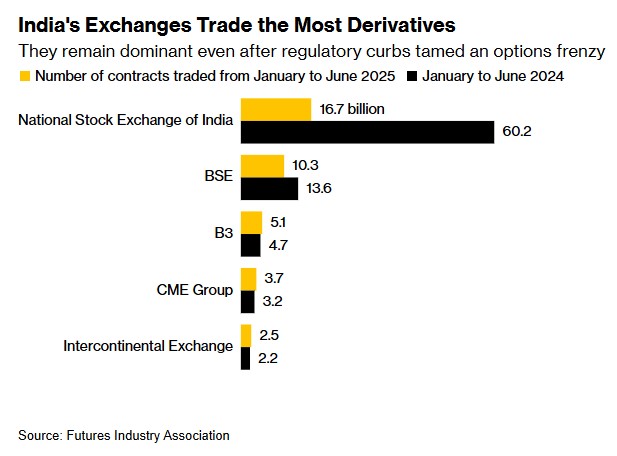

Bloomberg pointed out that the hiring spree comes despite stricter rules aimed at protecting loss-making retail investors. SEBI’s regulatory measures cut derivatives trading volumes by more than 40% from last year’s peak. Yet, the lure remains strong: foreign funds and algorithm-driven proprietary desks booked $7 billion in gross profits in India in the year to March 2024.

“The demand for profitable traders is as strong as ever,” said Daniel Vaz, co-head of quant and trading technology recruiting at Aquis Search. “We’re seeing inquiries to set up new desks almost every month, with fierce competition for top traders, quant researchers, and trading engineers in India.”

Rising scrutiny

Regulators are stepping up oversight. In July, SEBI accused Jane Street Group LLC of using its trading and tech power to sway prices on expiry days, reaping big profits. The firm, temporarily banned, disputes the claims and is challenging the order, saying it lacks access to key documents needed for its defense.

Despite this, major players remain committed. Firms like Estee Advisors and iRage Broking Services LLP say clients are still eager to enter the market, even if some are more cautious.

Expanding operations

Optimus Prime Securities & Research has recently scaled up its HFT business.

The Bilakhia Group plans to enter the space via Minix Holdings.

Citadel Securities, billionaire Ken Griffin’s firm, hired an options trader in India last month and intends to expand further. The Miami-based firm opened a Gurugram office in 2022 and now has over a dozen employees. It has also invested, along with Tower Research, in the National Commodity & Derivatives Exchange Ltd.

“Interest is very strong — and with some of the Jane Street issues being clarified, it will only grow,” said Sandeep Tyagi, founder of Estee Advisors.

Luring talent early

To secure the best talent, firms are hiring interns straight out of Indian Institutes of Technology (IITs). Their pay packages dwarf those offered by most other industries. Notably, this year’s lucrative offers were made after regulators cracked down on options trading but before the Jane Street ban.

The trading game evolves

Technology is reshaping the landscape. By March 2025, algorithms executed 70% of equity derivatives trades by value, up from 60% three years earlier, according to the National Stock Exchange of India.

That shift has shortened the shelf life of profitable strategies.

“Earlier, a strategy could run six months. Now it lasts about two,” said Rajib Borah, CEO of iRage. “You need to adapt faster. As more firms chase the same opportunities, ‘alpha decay’ — the erosion of an edge — accelerates.”