• ICICI Bank (ICICIBC) reported a beat on operational fronts, aided by lower NIM compression and lower credit cost from our expectations, opex in-line with estimate and an in-line growth in advances and deposits. LDR and LCR both remain at comfortable level of 86.6% and 121% respectively. Slippages increased, but higher recoveries & upgradation and writeoffs led to an improvement in asset quality.

• Advances grew 18% YoY and 4% QoQ aided by a healthy growth in retail and SME advances. Domestic loans grew 19% YoY and 4% QoQ. Overseas loans grew 7% QoQ and 10% YoY and constituted ~3.4% of overall advances. Deposits grew 3% QoQ and 19% YoY, led by term deposits (up 31% YoY and 5% QoQ). CASA grew a mere ~4% YoY (flat QoQ), resulting in a decline in the CASA ratio (down 572bp YoY and 112bp QoQ). Average LCR stood at 121%.

• NIM (reported) compressed by 22bp YoY and 10bp QoQ to 4.43% (2bp higher than our estimate) due to a 18bp QoQ jump in CoF v/s 7bp QoQ jump yield on assets. NII grew 13% YoY and 2% QoQ due to a compression in margin (in line).

• Other income grew 21% YoY and 6% QoQ led by treasury income, which stood at INR123cr versus(INR85cr)/INR36cr in Q2FY24/Q3FY23. Fee income grew at moderate pace of 2% QoQ and 19% YoY. Net revenue grew 15% YoY and 3% QoQ. • Operating expenses were broadly in line, up 22% YoY and 2% QoQ to ~INR10,050cr. Hiring has been elevated for the last four-to-five quarters; however, it started moderating from last quarter. Other operating expenses were elevated due to promotional activities during the festive season and marketing and branding-related costs. PPOP grew better than expected at 11% YoY and ~3% QoQ. Core operating profit grew by ~10% YoY.

• Credit cost, at 36bp (annualised), was lower than our estimate of 40bp and this includes INR 627cr of provision for an investment in AIFs. As a result, PAT grew 24% YoY (flat QoQ).

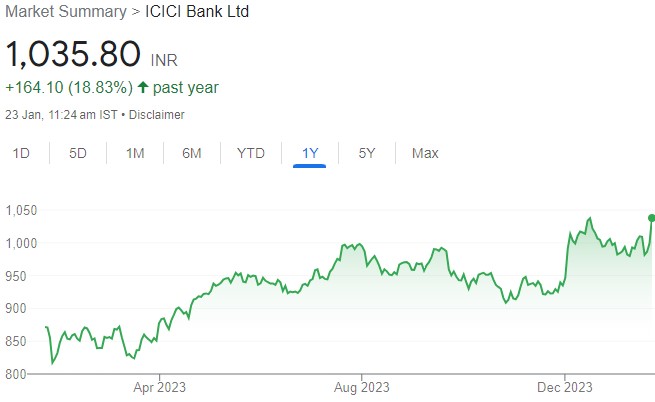

• RoA/RoE rose 12bp/90bp YoY, but fell 9bp/60bp QoQ, to 2.3%/18.5%. Although NIM is likely to face some pressure, ICICIBC will sustain its strong performance on most parameters. We reaffirm ‘Tactical BUY’ with a TP of INR1,195.

Retail and SME loans drive credit growth

Advances grew 18% YoY and 4% QoQ led by retail loans (mix: 54.3%), which grew 21% YoY and ~5% QoQ. Within retail loans, PL/CC grew at a healthy 37%/40% YoY and 6%/11% QoQ. This led to the share of unsecured loans within the retail book rising to 25% from 22% in Q3FY23. Housing and vehicle loans each grew 4% QoQ. SME/business banking grew 28%/32% YoY and 7% each QoQ. The domestic corporate book grew at a moderate pace of 13% YoY and 3% QoQ, partly aided by ~7% QoQ decline in NBFC loans, constituting 6.4% of advances v/s 7.2% in Q2FY24.

Slippages elevated but healthy recoveries and write-offs led to better asset quality

Slippages rose 22% QoQ to INR5,710cr led by retail, rural, and business banking, which contributed 96% to total slippages. Of this, slippages from kisan credit card stood ~INR620cr. Recoveries and upgrades stood at INR5,350cr, of this, retail, rural, and BB contributed 59%. In Q3FY24, write-offs stood at INR1,390cr versus INR1,920cr QoQ and INR1,160cr YoY. This resulted in a 4% QoQ decline in absolute GNPA. GNPA improved by 18bp QoQ to 2.3% and NNPA stood unchanged at 0.44%. The restructured book stood ~INR3,320cr (0.3% of net advances) versus ~INR3,540cr QoQ and INR4,990cr YoY. The bank holds provisions of INR1,030cr against this. PCR stood ~81% versus 83% in Q2FY24 — one of the highest among large private banks.

Valuation and view

ICICIBC reported a steady set of earnings with a comfortable LCR and LDR. NIM contraction was lower than expectation, resulting in a beat on the operating front. We expect superior performance on most parameters to continue, given its strong digital push, focus on risk calibrated operating returns, and a strong Balance Sheet. We maintain ‘BUY’ with a TP of INR1,195, a 19% upside from its CMP.

Click here to download icici bank q3fy24 result update by Nuvama