Portfolio of Alchemy PMS Funds

We can get a clear idea of the stocks that Hiren Ved is bullish on by peering into the stocks held by the PMS Funds that he manages.

Portfolio Holdings of the Alchemy High Growth PMS

| Holding | % |

|---|---|

| ICICI BANK LTD | 7.95 |

| BAJAJ FINANCE LTD | 7.66 |

| PRAJ INDUSTRIES LTD | 7.03 |

| P I INDUSTRIES LTD | 6.56 |

| HDFC BANK LTD | 5.90 |

| AVENUE SUPERMARTS LTD | 4.94 |

| MARUTI SUZUKI INDIA LTD | 4.81 |

| DIVI’S LABORATORIES LTD | 4.64 |

| EICHER MOTORS LTD | 4.42 |

| TITAN COMPANY LTD | 4.32 |

| Top 10 Equity Holdings | 58.22 |

Portfolio Holdings of the ALCHEMY High Growth Select Stock

| Holding | % |

|---|---|

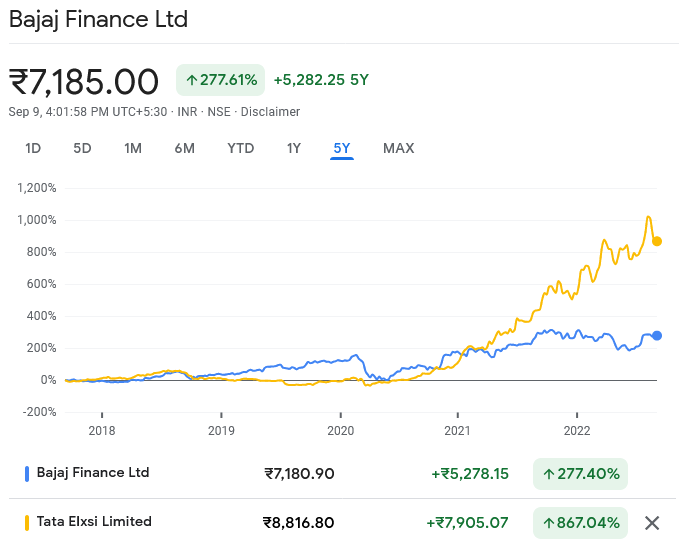

| TATA ELXSI LTD | 12.94 |

| BAJAJ FINANCE LTD | 8.22 |

| ICICI BANK LTD | 5.19 |

| DIVI’S LABORATORIES LTD | 4.59 |

| UNITED SPIRITS LTD | 4.01 |

| TATA CONSUMER PRODUCTS LTD | 3.51 |

| RELIANCE INDUSTRIES LTD | 3.43 |

| INFO EDGE (INDIA) LTD | 3.43 |

| DIXON TECHNOLOGIES (INDIA) LTD | 3.32 |

| VARUN BEVERAGES LTD | 2.99 |

| Top 10 Equity Holdings | 51.63 |

Source: pmsaifworld.com

The top ten holdings make up more than 50% of the allocation in both schemes, indicating a fairly concentrated portfolio.

Bajaj Finance and ICICI bank are far better placed in the banking sector

Bajaj Finance and ICICI Bank have been Hiren Ved’s all-time favourite stocks since the time they were minnows.

He had recommended Bajaj Finance as far back as in 2013. “Bajaj Finance is actually a no. 1 financial bet. It is one of the best management teams in terms of execution … we got earnings growth, multiple expansion … I see no reason why Bajaj Finance cannot trade at three times book,” he had rightly advised.

He repeated similar advice in his latest interview to Business Today: “Clearly there are players like ICICI bank and Bajaj Finance, who are far better placed. However, if you look at the price action and performance, many of the smaller private banks are also doing very well, and also some of the PSU banks have done phenomenally well,” he stated.

Automobile and specialty chemicals sector can grow at very healthy double-digit rates

A look at the two portfolios shows that Hiren Ved has invested in multiple stocks from the automobile and specialty chemicals sectors such as Maruti Suzuki, Eicher Motors, Praj Industries, PI Industries etc.

He expressed the view that the automobile and specialty chemicals sector have potential to grow at very healthy double-digit rates. He also advised us to focus on domestic demand-oriented sectors and structural growth areas such as engineering research and development, design, specialty chemicals and consumer discretionary– liquor and quick-service restaurants.

“India is likely to see secular growth in earnings and, is placed fairly well in terms of the growth cycle,” he explained.

“Manufacturing in India, whether you play through industrial or capital goods is likely to have a 10-year bull run. In my view, capital goods have a huge structural growth story,” he added.

“You got to be more aligned with companies that are focused on either new energy, electric vehicles, solar, or some part of the value chain where they will benefit because that’s exactly where the spending is likely to happen,” the veteran added.