Unlocking the power of continuous growth!

India’s Electronics Manufacturing Services (EMS) industry is witnessing a strong revenue growth trajectory, primarily driven by healthy industry demand, the addition of new segments and onboarding of new customers, increasing domestic manufacturing, import substitution, and global partnerships. In this report, we discuss the healthy revenue growth visibility within the sector and the scope to improve margin, leading to a strong earnings growth trajectory. Our coverage universe includes Kaynes Technology (KAYNES), Avalon Technologies (AVALON), Syrma SGS Technology (SYRMA), Cyient DLM (CYIENTDL), Data Patterns (DATAPATT), Dixon Technologies (DIXON), and Amber Enterprises (AMBER).

The industry reflects strong growth visibility with an aggregate order book (excluding Dixon and Amber) of INR141b as of Jun’24 (almost twice the FY24 aggregate revenue). Moreover, majority of the players are working on adding new segments and are onboarding new customers, which suggests sustained order inflows going ahead.

EMS companies witnessed strong revenue growth in FY24/1QFY25; however, the margin contraction hindered their earnings growth trajectory. We believe that a substantial part of the challenges is behind the companies, and majority of the players are expected to either recover or at least maintain their current margin profile.

Accordingly, we expect earnings growth momentum in the EMS industry to accelerate, led by a strong execution of the growing order book from existing and new end-user industries, coupled with margin recovery. We expect our EMS coverage companies to report a CAGR of 47%/49%/51% in revenue/EBITDA/adj. PAT over FY24-FY26.

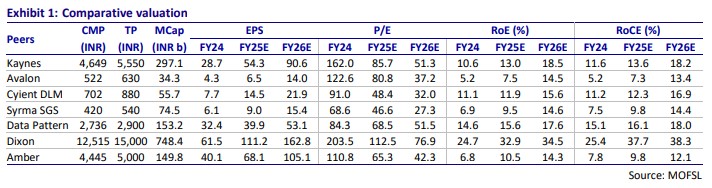

Valuation and view: EMS industry witnessing an uptrend

Our aggregate revenue for the EMS coverage basket is expected to clock a 47% CAGR over FY24-FY26, driven by order flows from new as well as existing segments in both domestic and international markets in areas such as high computing servers, railways, A&D, medical and healthcare, clean energies, EV, automotive, and industrials.

Consequently, the combined EBITDA margin is likely to expand ~20bp over FY24- FY26, led by favorable operating leverage. Accordingly, EBITDA is expected to clock a CAGR of ~49% during FY24-FY26.

We reiterate our BUY rating on KAYNES/AVALON/CYIENTDL/SYRMA/DIXON/ AMBER with a TP of INR5,550/INR630/INR880/INR540/INR15,000/INR5,000 for FY26. We retain our Neutral stance on DATAPATT with a TP of INR2,900 for FY26.

India’s Electronics Manufacturing Services (EMS) industry is witnessing a strong revenue