Best domestic consumption play

We upgrade INDIGO to BUY as we believe that benign Brent crude prices amid the ongoing geopolitical turmoil and favorable domestic demand bode well for the company. We assign a TP of INR6,550 premised on 10x FY27E EV/EBITDAR. The stock currently trades at a P/E of 20x FY26 EPS and 9.7x FY26E EV/EBITDA. We estimate a CAGR of 28%/38% in EBITDA/PAT during FY25-27E.

We lowered our Brent assumption for FY26-27E to USD65/bbl (from USD70/bbl), based on the following factors: (1) there is going to be a gradual unwinding of OPEC+ voluntary cuts from Apr’25 and (2) IEA projects that global supply is likely to exceed demand and the demand-supply gap is set to widen as voluntary cuts unwind from Apr’25. For INDIGO, aircraft fuel accounts for ~40% of total expenses; therefore, softer crude prices bode well for the company.

INDIGO has been on an upward trajectory after Covid – gaining market share in the domestic market (aided by the insolvency of GoFirst in May’23), expanding its international and cargo business, adding new destinations/routes, signing codeshare agreements, and procuring delivery of aircraft from OEMs. These factors have helped the company maintain profitability for the past two years and will continue to drive its performance in the coming years.

Valuation and view

INDIGO has adopted a completely different operational strategy after Mr. Pieter Elbers joined the company as the new CEO in Sep’22. He has over 30 years of experience working at different positions at KLM Royal Dutch Airlines. His wealth of experience has not only helped INDIGO compete with global majors but also consistently increase its market share in the domestic market. This could also pose as a ‘Key Man’ Risk.

INDIGO serves over 100m passengers and adds one aircraft a week (on average). It has expanded its international share to ~28% in FY25 of Available Seat Kilometers (ASK) through strategic airline partnerships. The company focuses on strengthening its global presence via loyalty programs and proactive brand building efforts while continuously refining schedules to enhance reliability and attract a larger share of international travelers.

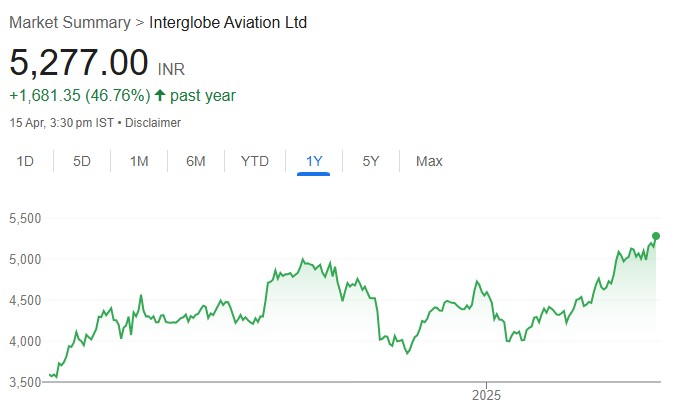

The stock is trading at ~20x FY26E EPS of INR257.9 and ~10x FY26E EV/EBITDAR. We upgrade the stock to BUY with a TP of INR6,550, based on 10x FY27E EV/EBITDAR. Key downside risks: 1) delays in wide-body aircraft deliveries or rising AOGs; 2) sharp volatility in crude or rupee could pressure margins if not passed on; 3) a higher share of business-class seating or premium fleet may dilute INDIGO’s cost advantages.