Equity Initiation Note

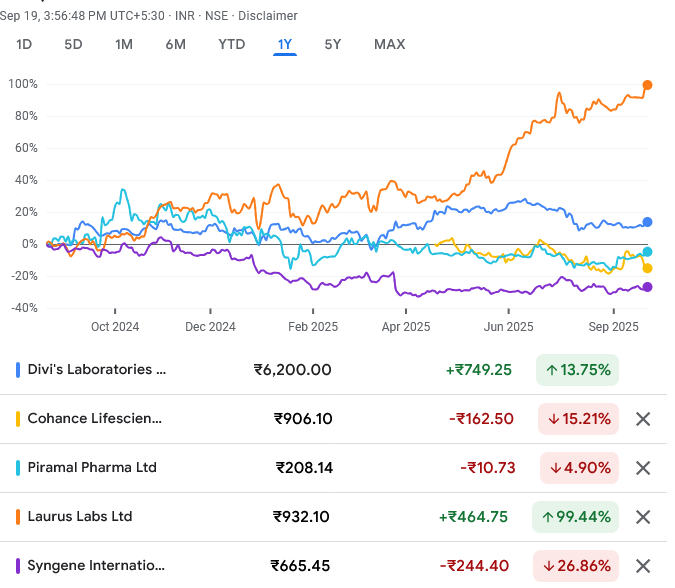

Divi’s Laboratories Ltd. (DIVI IN) | Cohance Lifesciences Ltd. (COHANCE IN)

Initiation: Overweight | Divi’s PT: ₹7,800 | Cohance PT: ₹1,300

Investment Thesis

JPMorgan initiates coverage on Divi’s Labs and Cohance Lifesciences with Overweight ratings, underpinned by robust structural growth in India’s CRDMO market. The sector is expected to expand at a 13% CAGR, reaching $15.4bn by 2029 from $8.2bn in 2024. Indian CRDMOs are positioned to benefit from:

-

Structural tailwinds in outsourcing and specialty manufacturing.

-

Heavy capacity additions with ~30% of gross block allocated to capex.

-

Relative insulation from tariff-related risks.

JP Morgan projects sector-wide 17% revenue CAGR and 20% earnings CAGR over FY25–FY28E, supported by robust RFQ flows and scale expansion.

Company Highlights

Divi’s Laboratories

-

Established sector leader with organically built scale.

-

Strong process chemistry expertise and proven execution track record.

-

Positioned to sustain above-industry growth and margin resilience.

Cohance Lifesciences

-

Emerging CRDMO player with accelerated growth trajectory.

-

Expanding into ADC (antibody-drug conjugates), enlarging addressable market nearly 7x to $1.8bn via acquisitions.

-

Provides investors exposure to a differentiated, high-growth niche.

Valuation & Catalysts

-

Divi’s PT ₹7,800: supported by premium multiple justified by scale, execution, and margin strength.

-

Cohance PT ₹1,300: based on ADC pipeline expansion, inorganic growth optionality, and improving visibility.

-

Catalysts: new contract wins, capex ramp-up execution, and faster-than-expected ADC commercialization.

Key Risks

-

Regulatory: Evolving US/EU compliance requirements could impact approvals.

-

Client Concentration: Heavy reliance on key clients exposes revenue stability.

-

Global Demand Trends: Macroeconomic slowdown or shifting outsourcing patterns may pressure growth.

-

Execution: Cohance faces risks in acquisition integration and ADC scale-up.

-

FX Volatility: INR/USD fluctuations may impact margins.

Bottom Line: With strong fundamentals, capacity-led growth, and differentiated positioning, JP Morgan views both Divi’s Labs and Cohance Lifesciences as high-conviction Overweight ideas in India’s CRDMO sector.