Worst behind, ramp up at new outlets to drive growth

About the stock: Landmark Cars is a leading auto retailer for premium/luxury cars in India. Its key OEM partners in PV space include Mercedes Benz, Jeep, Honda, Volkswagen, Renault with recent additions being MG Motors, Mahindra & Mahindra, Kia & BYD. It has also partnered with Ashok Leyland in the CV space.

• It has a network of 135 outlets (sales showroom + Workshops) spread across 11 Indian states and 31 cities. It also has 7 upcoming outlets.

Q3FY25 Results: Topline for the quarter came in highest ever at ₹1,195 crore (up 24.6% YoY). EBITDA in Q3FY25 came in at ₹66.5 crore (up 2% YoY and 28% QoQ) with corresponding EBTDA margins at 5.6% (down 124 bps YoY, 16 bps QoQ). Resultant PAT for the quarter came in at ₹12 crore vs. ~₹ 19 crore in Q2FY24.

Investment Rationale

• Landmark cars best placed to play premiumisation trend in PV space: Luxury car penetration in Indian PV market stand at ~1%, one of the lowest globally. In CY24, Domestic annual luxury car sales stood at ~51.5k units amidst total PV sales pegged at ~4.3 million units. Thus, with significant growth in income levels, consequent rise in HNI’s/UHNI’s share of population & growing consumer preference for premium products, there exists significant tailwind of growth for luxury car segment in India. As per industry estimates, luxury PV segment is expected to grow healthy double digit in volumes vs. mid-single digit long term growth envisaged for the PV space in general. Landmark is strategically positioned to seize this opportunity, leveraging its long-standing relationships with existing marquee OEM partners like Mercedes Benz, etc. as well as diversifying its offerings with other OEMs like BYD, M&M, Kia Motors and MG Motors. With new outlets in place, we bult in new car sales revenues to grow 17% CAGR over FY24-27E to ₹ 3,941 crore in FY27E vs. ₹ 2,438 crore in FY24

• After-sales service to cushion earnings and RoCE recovery: After-sales service and aftermarket sales is the most lucrative business proposition for the auto retailer and provides stability to the overall earnings and return ratios profile. EBITDA margins in this business are at ~18%. Landmark drives ~23% of its topline from this segment, the contribution of which to the total EBITDA is pegged at ~73%. Thus, with increasing car sales as well as ramp up at new workshops, the company is expected to witness a recurring & stable revenue stream from this segment thereby supporting the overall earnings & RoCE profile. We have built-in 12% sales CAGR in this space over FY24-27E to ₹ 1,200 crore in FY27E vs. ₹ 850 crore in FY24.

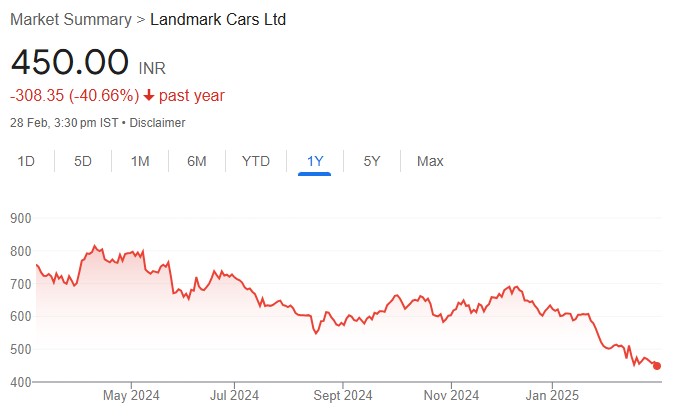

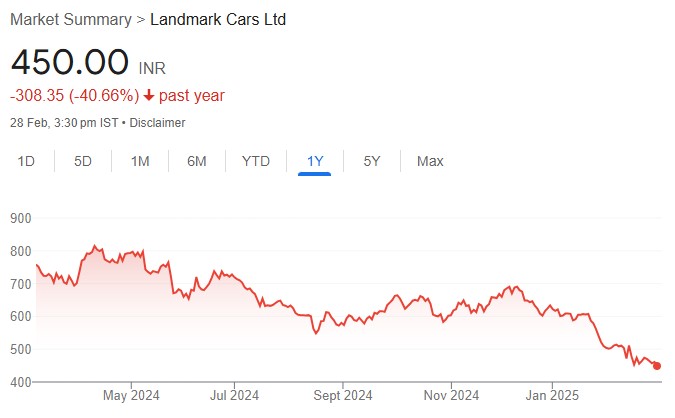

Rating and Target Price

• With large part of initial ramp up cost of new outlets behind us & company focussing on optimising sales at these outlets, we expect profitability to meaningfully improve at Landmark cars going forward. We believe current correction in stock price offers attractive risk-reward play. We assign BUY rating on the stock with target price of ₹ 620 i.e. 22x PE on FY27E.