TOP PICKS

Macro & Earnings will Continue to Drive the Market Fundamentals

Axis Top Picks Basket delivered a return of 6% in the last six months against the 5.5% returns posted by Nifty 50 over the same period. Amidst a highly volatile month of Jul’25, which witnessed notably mixed performance across sectors, market caps, and style indices, the Axis Top Picks basket declined by 2.7% MoM but managed to beat the benchmark Nifty 50, which declined by 2.9% over the same period. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 325% since its inception (May’20), which stands well above the 167% return delivered by the NIFTY 50 index over the same period.

Some Pull Back after 4 Consecutive Months of Run-Up: After seeing a run-up for almost 4 months, Jul’25 saw some pull back, led by mixed trends in the first phase of the ongoing earnings season. While companies delivered the results as per the market expectations, they failed to build firm forward-looking guidance in the initial phase. Nonetheless, downgrades have been limited by far. 69% of Nifty 50 companies so far have either beaten the earnings expectations or have been in line with them. Trends in Banks & NBFCs by far are in line with the expectations, with larger banks reporting slower NIM contraction while mid-small banks reporting sharper NIM contraction. The IT sector delivered as per the expectations but did not gain much strength due to the weaker macroeconomic environment in the developed markets. Cement companies showcased resilient performance. On the other side, the FMCG companies delivered muted performance, primarily impacted by the softness in urban demand, driven by heightened competitive intensity, subdued discretionary spending, and a lag in fiscal measures, translating into muted ground consumption. In contrast, rural markets continued to recover at a relatively faster pace.

Tariff Surprise Opens the Window for Negotiation: In a surprise move on the evening of 30th July’25, President Trump announced 25% tariffs on Indian goods starting from 1st Aug’25 and an additional penalty due of buying Defence and Energy from Russia. These tariffs are slightly lower than the earlier announcement of 26% but higher than Indonesia, the Philippines, and Vietnam, which are in the rage of 19 20%. The imposition of a penalty was an additional surprise for the market, as the announced 25% tariffs turned out to be higher than the market expectations of 18 20%. However, the details related to goods and sectors which would not be a part of these tariffs have not been revealed yet. In the coming weeks, the negotiation window is open and based on the behaviour of the last 3-6 months, it could negotiate to the lower levels. Nonetheless Indian market opened on a weaker note on the last working day of July’25 due to this surprise development. But keep in mind that our market had already corrected in July’25 due to mixed earnings in the first half. Even with the negative surprise, the limited downside during the day August 2025 reflects the resilience of the market and indicates that most of the negatives were already priced in. Buying interest was clearly visible across sectors and market caps, reinforcing underlying investor confidence.

We believe that at this juncture, despite external risks, India’s domestic growth trajectory remains intact, with key macroeconomic factors supporting a stronger FY26 compared to FY25. The RBI and government are providing support to the Indian economy through policy measures such as a 50bps CRR cut in Dec’24, 100 bps of rate cut till now, improved bank liquidity, the RBI Dividend, a consumption boost provided in the budget, and an uptick in the government CAPEX spending. So far, the progress of the monsoon is good, and so are the reservoir levels. All eyes are now on the further progress of the monsoon and the festival demand, which is likely to start from the Ganesh Chaturthi festival.

Style and Sector Rotation – A Key to Generating Alpha Moving Forward: Risk Reward is slowly building towards Mid and Smallcaps. Nonetheless, recovery will be slow and gradual as we progress towards FY26, led by strong earnings expectations, improving domestic liquidity, and stable Indian macros. We believe the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. As a result, we expect near-term consolidation in the market, with breadth likely remaining narrow in the immediate term. Against this backdrop, our focus remains on growth at a reasonable price, ‘quality’ stocks, monopolies, market leaders in their respective domains, and domestically-focused sectors and stocks. These, we believe, may outperform the market in the near term. Based on the current developments, we 1) Continue to like and overweight BFSI, Telecom, Consumption, Hospitals, and Interest-rate proxies, 2) Continue to maintain positive view in Retail consumption and selected FMCG play, 3) Prefer certain capex-oriented plays that look attractive at this point in light of the recent price correction as well as reasonable growth visibility in the domestic market in FY26, 4) Maintained cautious stance on export oriented sector due to tariff overhang and macroeconomic uncertainties.

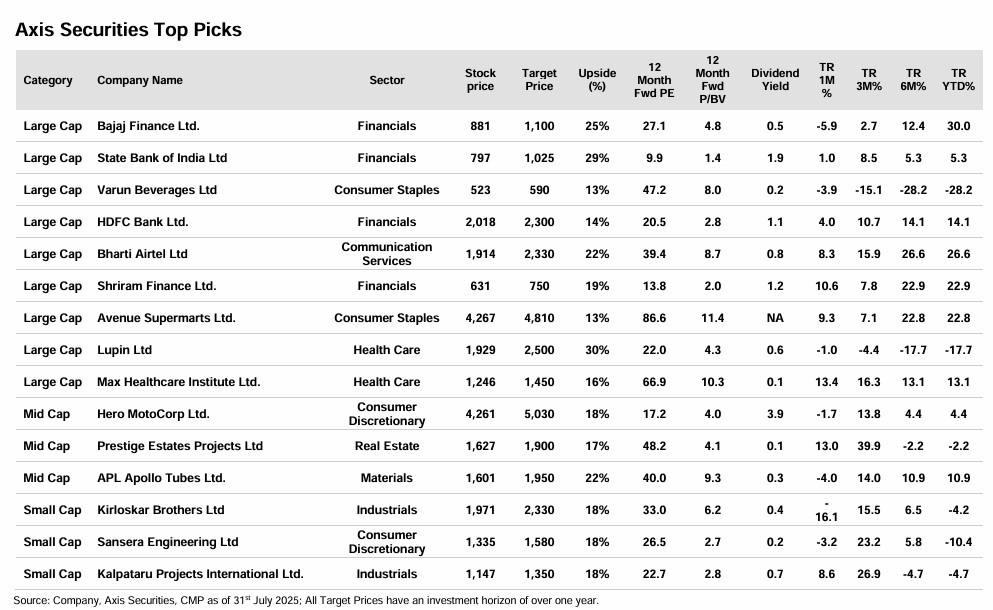

Based on the recent developments, we have made one change to our Top Picks recommendations. This includes the removal of Colgate India due to weaker-than-expected results and the addition of Kirloskar Brothers. Our modifications reflect the expectations of higher growth and margin profile going forward.

Based on the above themes, we recommend the following stocks: HDFC Bank, Bajaj Finance, Shriram Finance, Avenue Supermarts, State Bank of India, Lupin, Hero Motocorp, Max Healthcare, Kirloskar Brothers, Kalpataru Projects, APL Apollo Tubes, Varun Beverages, Bharti Airtel, Prestige Estates, and Sansera Engineering.