Summary

The company is optimistic of growth picking up at Axis Bank channel besides continued strong growth at its Proprietary channels and other bancassurance partnerships.

Thus, it is reasonably confident to deliver mid-teen APE growth with VNB margins at 24-25% in FY26.

The company is awaiting IRDAI approval for the reverse merger, a move contingent on upcoming amendments to the Insurance Act. This would entail the separate listing of Axis Max Life, removing hold co discount and unlock value.

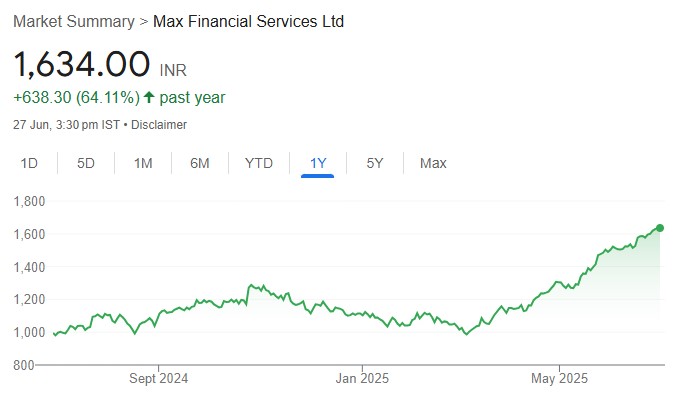

Stock trades at 2.3x/2.0x its FY2026E/ FY2027E EVPS. We maintain a Buy with a revised PT of Rs. 1,850.

Over the past three years, Axis Max life has posted strong industry leading APE growth of 18% with 13% VNB CAGR. The management aspires to continue to grow APE in mid-teens (300-400 bps higher than industry) with VNB margin at 24-25% in FY26. The company is focusing on further scaling up the proprietary channel, improving bancassurance productivity, maintain leadership in protection and online distribution. It is also optimistic of growth picking up at the Axis Bank channel. Proprietary channel’s APE grew by 26% in FY25 while bancassurance APE grew by 12% y-o-y. Axis Bank’s channel grew 10% while non-Axis Bank banca channel grew by 27%. Earlier, the key challenge was that it was largely dependent on Axis Bank channel for growth but over the past few years, the company has proactively expanded its agency and direct sales force, with significant investment in digital productivity, training, and performance-linked frameworks. With the bancassurance channel’s growth likely to pick up as deposit pressure eases and proprietary channels expand deeper into lower tier markets, APE growth visibility remains strong in near to medium term in the mid-to-high teens. Additionally, it is awaiting IRDAI approval for the reverse merger, a move contingent on upcoming amendments to the Insurance Act. This would entail separate listing of Axis Max Life, removing holding company discount and unlock value.