MCX was always a great buy due to its stranglehold of 90% market share in the commodity exchange market. However, the “pric gouging” tactic by 63 Moons, its software vendor, amidst delay in delivery of the new trading platform by TCS, sent the stock price tumbling to a 52-week low.

The issue was discussed threadbare here: MCX, the commodity exchange monopoly with over 90% market share, is in the doldrums due to “price gouging” by its software vendor 63 Moons

That was really the golden time to buy the stock by truckloads since it was obvious that TCS was working overtime to get the trading platform ready and once that hppended, the stock would resume its golden days.

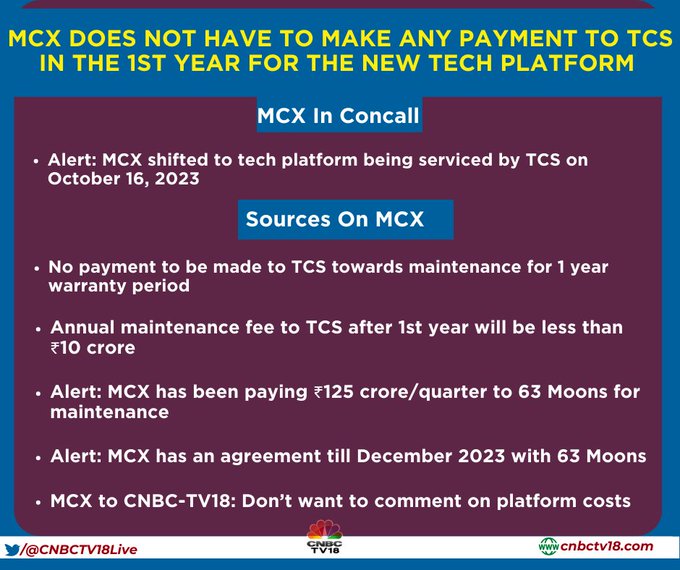

Well, today, the MCX stock surged 5% because CNBCTV18 reported that MCX is likely to pay software maintenance fee of less than Rs 10 crore per year to TCS once the one year warranty year period ends in September 2024. The Company in its concall has mentioned that it doesn’t has to pay to TCS in the 1st year.

The stock is a great buy given the growing market for derivatives in India. However, we will have to wait for a meaningful correction before buying the stock.