SoftBank aggressively bought $4 Billion worth of Call Options in FAANG stocks, equivalent to hundreds of Billions in value of the underlying, causing mammoth “shorts squeeze”

SoftBank, which is founded by visionary Billionaire Masayoshi Son, is contemptuously described as the “The Bubble Era’s ‘Short Of The Century’” by some knowledgeable persons.

This is because a number of large investments that it made in so-called “unicorns” such as WeWork, WireCard, Uber, etc have failed and caused a write-down of Billions.

According to reports, SoftBank, which once suffered the ignominy of bankrupcy during the DotCom crash, is once again facing the specter of having to be wound up due to the failed investments.

Apparently, in a desperate bid to shore up the value of its investments in tech stocks and also to deflect attention, SoftBank launched an audacious buying programme, scooping up massive truckloads of FAANG stocks such as Amazon, Alphabet Google, Microsoft, Tesla, Netflix, Zoom etc.

Then, it also bought Call Options worth $4 Billion in these stocks, which is tied to around $50 billion worth of individual tech stocks.

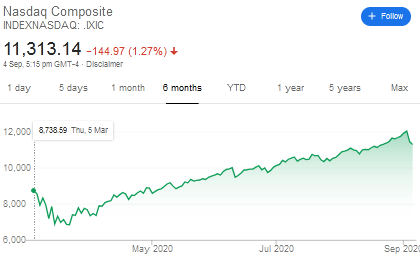

This aggressive and no-holds-barred buying action has led to the Mother of all Bull Runs in tech and other stocks.

In August alone, Tesla’s share price shot up 74 per cent, while Apple gained 21 per cent, Google’s parent Alphabet rose 10 per cent and Amazon 9 per cent.

According to ZH, SoftBank’s trade was simple: buy billions in underlying ultra-high beta stocks, then also buy billions in call options to take advantage of illiquid markets and gamma, and sure enough all the “SoftBank stocks” exploded to all time highs, and in the process dragged the entire market higher.

Japanese conglomerate SoftBank fueled the recent stock market rally by buying options tied to billions of dollars worth of individual tech stocks, people familiar with the matter say https://t.co/5qJeeaemXS

— The Wall Street Journal (@WSJ) September 4, 2020

Longers rush in, Shorters rush out

SoftBank’s aggressive buying became self-fulfilling because it attracted other longers and also forced shorters to cover.

“The sheer size of the trades exacerbated a “melt-up” in many big technology stocks … SoftBank was “gobbling up” options on a scale that was even making some people within the organisation nervous … People are caught with their pants down, massively short,” FT reported.

“These are some of the biggest trades I’ve seen in 20 years of doing this .. The flow is huge,” a hedge fund manager was quoted as saying.

“We are witnessing a battle of wills, high speculation where colossal call buyers are forcing the street to get long more and more stock to hedge their upside risk“.

“This can continue. The whale is still hungry,” it warned in an ominous tone.

not content with destroying pricing in the private markets, Masa Son and his merry band of mispricers brought their talents to the public markets https://t.co/waQCStEGbC

— modest proposal (@modestproposal1) September 4, 2020

SoftBank bought nearly $4 billion of shares in AMZN, MSFT, NFLX and TSLA

SoftBank spent another $4 billion on options for the same shares

This allowed SoftBank to profit from a run-up in the stocks by unloading its position to willing counterparties

https://t.co/z3Ly9Tko9p— JPR007 (@jpr007) September 4, 2020

Greater Fool theory at work

However, the savage crash of the NASDAQ on Thursday and Friday appears to be signalling a reversal of the trend, with the early longers trying to dump their holdings on the latecomers.

“It’s a high-stakes game of musical chairs, the ultimate greater fool theory moment. The colossal call buyer has thrown meat in the water and drawn in the sharks, but unfortunately thousands of Robinhood minnows at the same time. When the large players’ exit, the little guy and gal will be left holding the bag. As my first boss told me at Merrill Lynch in 1990, “In options Larry, they show it to you (lush $ green premium), and then they take it away,” Larry McDonald said in his famous Bear Traps report.

Also, it appears that SoftBank is caught in a trap and may have no option but to keep the momentum going by buying more and more options.

If the shorters sense any weakness on SoftBank’s part, they will double down and aggressively sell Calls and buy Puts, sending all the hard-won gains into thin air.

“A larger and longer-lasting stock-market decline would be more damaging for SoftBank’s strategy, and would involve rapid declines,” a wizened trader told FT.

Softbank bought billions of dollars of call options on tech according to the WSJ. That seems particularly ill-advised and could lead to more selling if we don't rally. Now after first buy, waiting.. https://t.co/2Cj9QmVLog

— Jim Cramer (@jimcramer) September 4, 2020

Stocks lose their gains for the day, Nasdaq quickly slips more than 3% as tech stocks resume sell-off https://t.co/dX0VlkhqjJ pic.twitter.com/BRda9Cuvxy

— CNBC Now (@CNBCnow) September 4, 2020

The U.S. stock market has grown top-heavy. The top five stocks in the S&P 500 Index account for 24.4% of the index — the most since at least 1972. The S&P 500 would be down if not for the FANMAG stocks ($FB, $AAPL, $NFLX, $MSFT, $AMZN, $GOOG).

— Mark Minervini (@markminervini) September 4, 2020