ET has reported that Citigroup has, in its latest report, adjusted its December-end target for theSensex to 32,200 from 33,000 earlier to factor in earnings cut. They have also introduced a Jun16 target of 35,000. The equivalent Nifty targets are 9,760 for Dec-15 and 10,600 for Jun-16.

Citi has raised its market target multiple from 16x to 17x – a slight premium over its longer-term average multiple – on the basis that with rates set to drop further, India could justifiably trade at higher multiples.

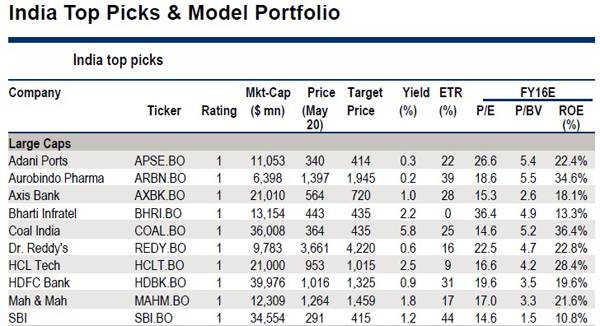

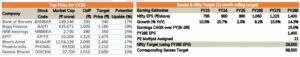

Citigroup has given several other reasons why Indian stocks will out-perform. In the Model portfolio, the top large-cap picks include names like Adani Ports, Aurobindo Pharma, Axis Bank, Bharti Infratel, Coal India, Dr Reddy’s Laboratories,HCL Technologies, HDFC Bank, M&M and State Bank of India.

(Image Credit: ET)

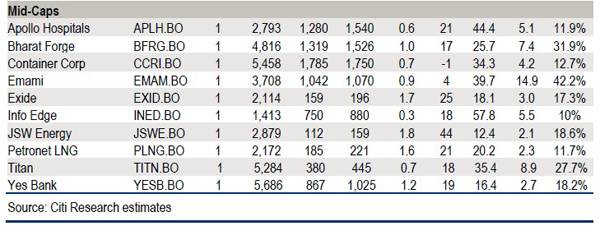

Amongst the midcap picks, there are stocks like Apollo Hospitals, Bharat Forge, Container Corp, Emami, Exide, Info Edge, JSW Energy, Petronet LNG, Titan Company, and Yes Bank.

(Image Credit: ET)

Small and microcap will become multibagger. Munjal Showa and madhav marbles are one of them.

My Facebook page name – GURU VACHAAL

can you give some logic behind your ideas…then people may be more interested ?

Orbit exports has delivered fantastic results.. Grab as much as you can before some HNI starts grabbing big chunk of it.

The market is range bound ,some days back Tech mahindra was suggested to purchase ,today the same has been below Rs.550/- & there are chances that it may below Rs.450/- in coming days. So its very risky & a layman can not sustained in such a market where all the TV channels are claiming to become a long term investor . Today even our Ex PM is absconding from his responsibilities ,So what to talk about others.