If you buy HDFC Bank when it underperforms, you will prosper

HDFC Bank has a glittering track record on the Bourses.

It qualifies as a textbook example of a “compounding machine“.

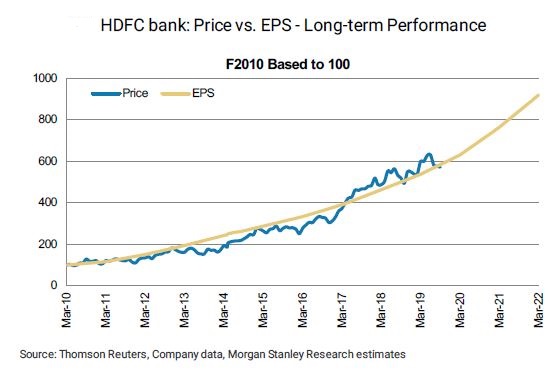

Morgan Stanley has pointed out that since FY2010, the stock price and earnings per share (EPS) have both registered a fabulous CAGR of 20 percent.

This has led the stock to deliver eye-popping gains of 668 percent over the past 10 years.

However, there are occasions when the stock price has not tracked earnings over one to two years.

This provides the golden opportunity to intrepid investors.

Buying the stock during these periods has historically generated outsized returns, Morgan Stanley says.

“We believe that the stock currently offers such an opportunity,” it is added.

Weakness in banking space is a blessing in disguise because arch rivals are feeble

It is no secret that investors are presently loath to buy NBFC and Banking stocks owing to the surging NPAs and other ailments.

However, these problems have proved to be a blessing in disguise for HDFC Bank.

The competition (such as Yes Bank, Axis Bank, IndusInd Bank etc) have become feeble owing to surging NPAs.

This has enabled HDFC Bank to snatch market share from the arch rivals, says Morgan Stanley.

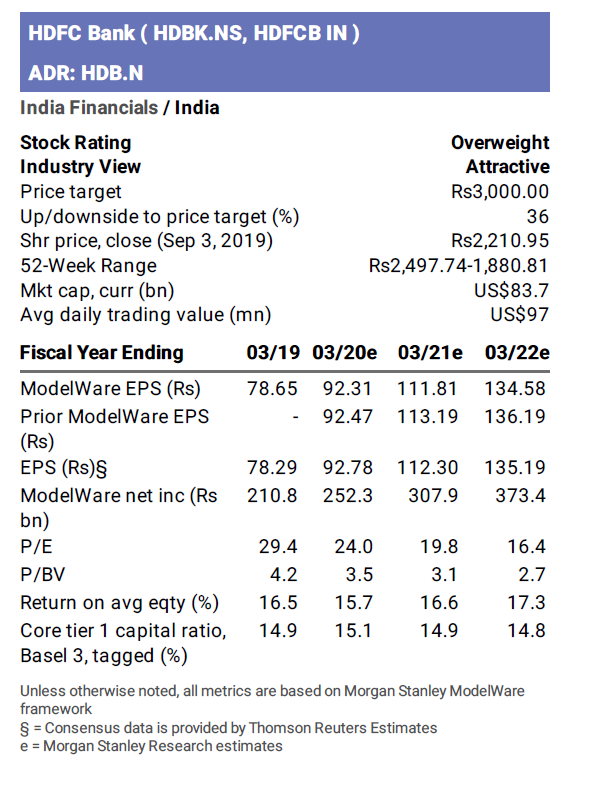

Morgan Stanley has also opined that HDFC Bank’s loan growth will remain very strong for the next two to three years.

“Investment in technology and increase in rural penetration (organic and in partnership) should enable it to keep growing loans. There will be some quarterly volatility given the size, but the backdrop for the bank will keep growing at 18-20 percent,” it said.

HDFC Bank is a “solid long-term play”

Morgan Stanley has described HDFC Bank as a “solid long-term play“.

The logic is that HDFC Bank has a good funding franchise and low-cost deposits, which are around 40 percent of total deposits.

In addition, HDFC Bank has sustained strength in loan growth and margins and acceleration in earnings growth in the coming quarters.

“Earnings outlook of HDFC Bank is strong with CAGR at nearly 20 percent over the next three years. Compounding implies meaningful margin of safety for longer-term investors.

Historically, the stock has done well over a 12-month period from current levels and we would expect similar performance,” Morgan Stanley said.

HDFC Bank is an “alluring investment opportunity“: Nomura

Nomura, also an elite merchant banker, has also given HDFC Bank a clean chit and described it as an “alluring investment opportunity“.

“We do not see any significant challenges to its ability to compound earnings and estimate 18 percent CAGR over FY19-21F,” Nomura opined.

I am buying HDFC Bank every single day for past 9 months: Saurabh Mukherjea

Saurabh Mukherjea, the authority on Coffee Can Investing Portfolio, has also come out with all guns blazing in favour of HDFC Bank.

“Our consistent focus has been to look for companies with outstanding fundamentals …. Every single day, for the last 9 months, we have bought HDFC Bank for our clients’ portfolio. I also hold it in my own portfolio,” Saurabh said.

#MarketMaster | Saurabh Mukherjea, Marcellus Investment Managers says believe the market is bracing itself for a poor Q2 earnings season; @KotakBankLtd, Bajaj Finance & @HomeLoansByHDFC are good picks for a portfolio#OnCNBCTV18 @latha_venkatesh @_anujsinghal @_soniashenoy pic.twitter.com/jgvcHGmIin

— CNBC-TV18 News (@CNBCTV18News) August 30, 2019

Every one know this Crisis in India is Man Made,but The Man who made it enjoying his life ,like no body has enjoyed in past ,and we all investors are suffering.

Evergreen stock

This guy also recommending good stocks now means market has made a bottom

The BIG question is : “Is someone cunningly trying to distribute BIG LOTS slowly to Public Investors by promoting HDFC Bank’s HYPE ?” “Where were they ALL ULTRA SUPER GENIUS GONE, when HDFC Bank was available at ONLY @ Rs. 25 in late 1990 ?” … THAT WAS THE REAL VALUE PICK & not at Rs. 2200+ share !!! … and because VERY recent decision of RBI to use “External Bench Mark” for ALL lending decisions for Retail & Corp. Borrowers will be VERY NEGATIVE FOR INDIAN BANKING SECTOR. …

Given CURRENT Global Economic Problems … Banking Sector as a whole is at a great risk if you consider next 5 to 10 years time period as your investment holdings period … Go BLINDLY BUY Precious Metals like Gold / Silver to protect your future over next 5 to 10 years !!!

Posted in LARGER PUBLIC INTEREST !!

AB

Very right analysis of current market and the banking industry in particular because the future does not look very encouraging.

HDB Financial Services is a subsidiary of HDFC Bank. IPO is likely to come next year.

We are selling these shares in demat mode at 1010/- per share.

Anyone interested in selling please inform me through email:

jay_shahgm@yahoo.com

HDFC Bk PE is close to 28 where its topline is growing at 18%. I don’t think it can achieve an annual growth of 28% to justify its PE. It is the same story with all the large caps. There are very few stocks in India that can withstand the downside of the market and all the MFs are flooding their SIPs money on these few defensive large caps irrespective of their story (PE, Growth, ROCE and so on). I somehow believe value buying is no more in existence.

Krish,

In Indian Capital Markets, most high priced (may not be high valued) stocks are just “maintained” in some price-band as may be desired by Operators by simply managing demand-supply of that stocks (read circular trading), just like the way they ALWAYS manage “Indexes” just to show that market has NOT GONE DOWN MUCH … but the matter of fact is: … See the prices of mid & small & micro caps … you will know what I wants to say! from Porinju to Ramdeo Agrawal … all are saddled with large losses … almost all retail investors including myself are in losses …

“BTW, if the HDB Fin. Serv. is a subsidiary of HDFC Bank, how & who can sell their shares PUBLICLY ? Any Idea Jay_ShahGM ?”

When we have a ‘MA History” passed “RBI Governor” & a Railway Station Chai-Vendor as PM, what can happen to Markets ? … These so called experts are AFRAID TO TELL THE TRUTH to the Govt. or anyone with Power & Position ? They are not even ashamed of falsely praising them ! We are at “Moral’s rock-bottom” levels ! …

AB