New Year, New Horizons: Key Themes to Supercharge Your Investments

Outlook 2024: The Indian economy continues to be a ‘star performing’ economy as against other emerging markets. Moreover, we firmly believe that it is likely to continue its growth momentum in 2024 and remain the land of stability against the backdrop of a volatile global economy. The majority of the high frequency indicators are trending upwards and the uptick from the pre-Covid levels is visible, indicating the resilience of the Indian economy. On top of it, the macroeconomic scenario has changed in favour of the equity market in the last one month and multiple indicators are now indicating a positive start for 2024. It is also noteworthy that the US bond yields witnessed a correction of 110bps from its peak in the last one month, which is further supporting the rally.

Overall, the country’s macro set-up is positive. The fundamentals of Indian corporates have improved significantly and so has the profitability across the board. This can be seen in the cumulative and rolling net profit of the NSE 500 universe for the last 4 quarters (till Q2FY24), which crossed the Rs 12 Lc Cr mark. Moreover, after a muted performance for several years, the ROE of the broader market is improving as well. The bolstered balance sheet strength of corporate India and the significantly enhanced health of the Indian banking system are additional positive factors. These elements are poised to facilitate Indian equities in achieving double-digit returns over the next 2-3 years, supported by robust double-digit earnings growth. We foresee Nifty earnings to post 14% CAGR growth over FY23-26. In our base case, we foresee the Dec’24 Nifty Target at 23,000. For our base case, we assume the continuation of the political stability and consequent visibility on the policy continuity after the 2024 General Elections.

Key Monitorables in 2024: Multiple events are lined up in 2024 and the market will continue to closely monitor the developments around them. These key events are: 1) Interim Budget; 2) General Election 2024; 3) Expectation of the FED rate cut around May-Jun’24; 4) Full-year budget around Jul’24 after the formation of new government; 5) Expectations of interest rates cut by the RBI in sync with global rate cut, and 6) US Election in Nov’24. The abovementioned events are expected to keep the Indian equity market volatile and it could respond in either direction based on the developments. In any case, we continue to believe in the long-term growth story of the Indian equity market and believe it to be well-supported by the favourable structure emerging, with increasing Capex enabling banks to improve credit growth. With current valuations offering a limited scope of further expansion, an increase in corporate earnings will be the primary driver of the market returns moving forward. Hence, bottom-up stock picking with a focus on a combination of old economy + export stories would be a key to generating satisfactory returns in the next one year.

Factoring in all economic and market developments, we present the following Themes for 2024:

• Manufacturing: India is on the cusp of the Manufacturing up-cycle and is expected to gain further boost from the policy continuity post the General Election 2024

• PSU Banks: The PSU banks space is expected to continue its growth momentum moving forward. Banks remain well-poised to deliver a consistent RoA/RoE of 1%/15-16% with a scope for re-rating.

• NBFCs: Gold loans are witnessing increasing customer traction on account of higher gold prices, improving economic activity of NBFC gold loan customers, and increase in risk weight for consumer credit. This should support gold loan growth moving ahead.

• IT Services: IT services will be a beneficiary of the sector rotation theme. The segment will also gain further traction on account of the global interest rate cut cycle.

• Consumption: After a muted performance in 2023, the Consumption space is likely to gain traction in 2024. In particular, the QSR space is well-placed to deliver strong returns due to its current attractive valuations.

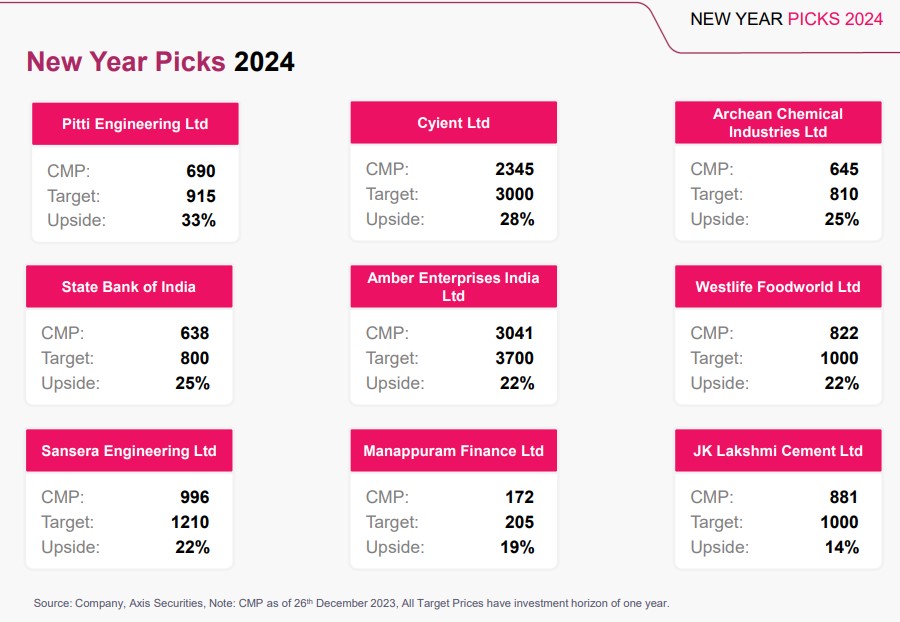

Our New Year picks for 2024 are: Pitti Engineering; Sansera Engineering; Archean chemicals; Amber Enterprises; JK Lakshmi Cement; SBI; Manappuram Finance; Cyient; Westlife Foodworld Limited