After moving into a range bound action for the last few sessions, Nifty witnessed sharp downside breakout of immediate support at 21900-21850 levels on Tuesday and is currently trading lower. The downside breakout has occurred after the bearish pattern formation as per weekly timeframe chart in the last week. The overall chart pattern is negative and the Nifty is expected to slide down further in the near term. Hence, we expect Nifty to trend lower in the coming week till 28 March 2024 expiry.

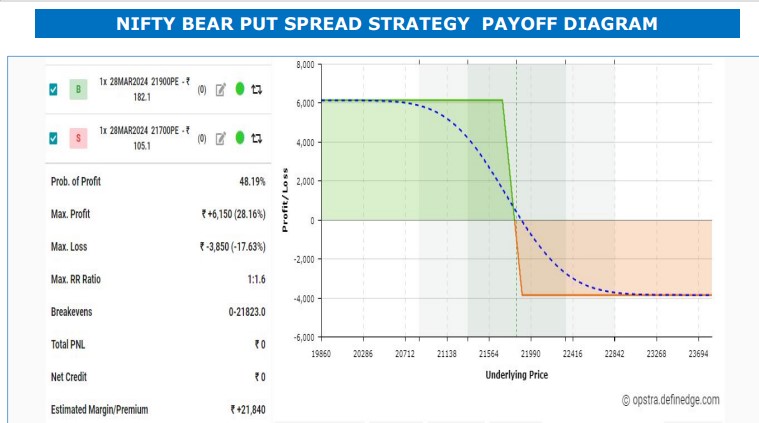

We therefore recommend a Bear Spread strategy in Nifty to profit from this view.

Action to be taken

Buy 21900 Put @ Rs 182.10 & Simultaneously Sell 21700 Put at Rs 105.10 (28-March Expiry)

(Approximate margin payable for the strategy Rs 22,000 (for exact margin, pls consult risk team

email or check margin calculator on website)

Max. Profit Rs 6150, If Nifty closes at or below 21700 on 28-March Expiry.

Max. Loss Rs 3850, If Nifty closes at or above 21900 on 28-March Expiry.

Breakeven point: 21823

Risk Reward Ratio: 1:1.60

* Please note, the spread position may be exited early depending on the reading of the market.

Click here to download HDFC securities Nifty Option Strategy 19 March 2024